POST-MARKET SUMMARY 10th January 2025

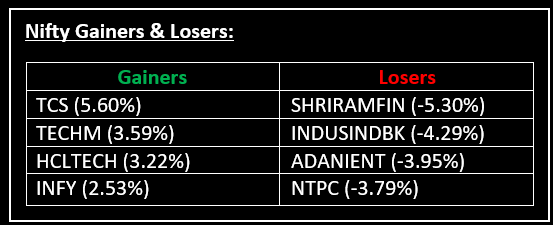

On January 10, the Indian market ended lower after a highly volatile session, marking its third consecutive day of losses. Top Gainer: TCS | Top Loser: SHRIRAMFIN

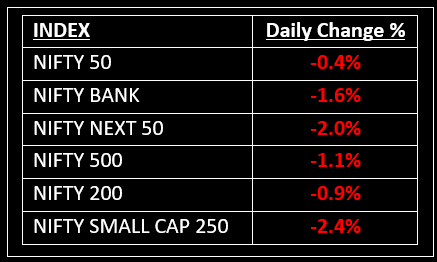

On January 10, the Indian market ended lower after a highly volatile session, marking its third consecutive day of losses. The market opened higher despite weak cues from Asian markets but quickly erased early gains within the first hour. Throughout the day, indices fluctuated between gains and losses before closing in negative territory.

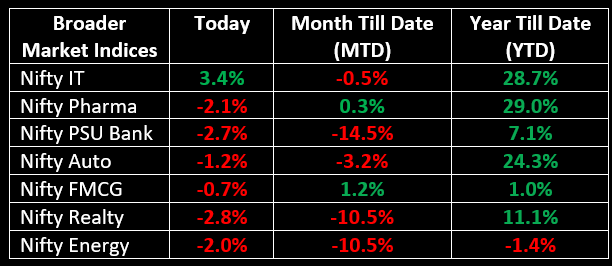

Sectorally, IT was the sole gainer, while power, PSU, realty, healthcare, and PSU Bank sectors declined by around 2% each, dragging the market lower.

NIFTY: The index opened 25 points higher at 23,551 and made a high of 23,596 before closing at 23,431. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,550 while its immediate support is at 23,300.

BANK NIFTY: The index opened 77 points lower at 49,426 and closed at 48,734. Bank Nifty has formed a large bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed around 49,000 while immediate support is around 48,500.

Stocks in Spotlight

▪ Delta Corp: Stock jumped 5% after the Supreme Court stayed GST show cause notices amounting to Rs 1.12 lakh crore issued to online gaming companies.

▪ Tata Elxsi: Stock plunged around 7% after the company reported disappointing Q3FY25 results, missing Street estimates. Net profit slipped 3.5% YoY to Rs 199 crore, while revenue from core operations climbed 3% to Rs 939 crore.

▪ Adani Wilmar: Stock hit the 10% lower circuit after promoter Adani Commodities launched a two-day offer-for-sale (OFS) for non-retail investors, with the retail portion set to open on January 13. The OFS includes 17 crore shares, representing 13.5% of Adani Wilmar's total equity.

Global News

▪ Gold prices scaled a four-week peak on Friday and were set for their best week in seven, driven by safe-haven demand amid uncertainties over President-elect Donald Trump’s policies, while markets awaited jobs data for clues on the trajectory of U.S. interest rates.

▪ The dollar looked set to log a sixth straight week of outperformance against other currencies on Friday, underpinned by elevated bond yields and expectations of another strong set of U.S. job numbers, while sterling continued to slide.

▪ Oil prices surged on Friday and were on track for a third straight week of gains as traders focused on potential supply disruptions from more sanctions on Russia and Iran.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.