POST-MARKET SUMMARY 10th December 2024

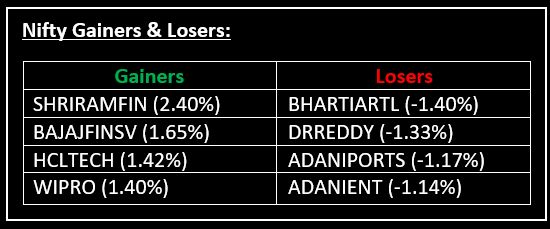

On December 10, the Indian benchmark indices closed flat after a highly volatile trading session. Top Gainer: SRIRAMFIN | Top Loser: BHARTIARTL

On December 10, the Indian benchmark indices closed flat after a highly volatile trading session. The market opened on a positive note and remained in green during the first half. However, profit-booking in the latter half dragged the indices into negative territory. Late buying, particularly in IT and realty sectors, helped recover losses and led to a near-flat close.

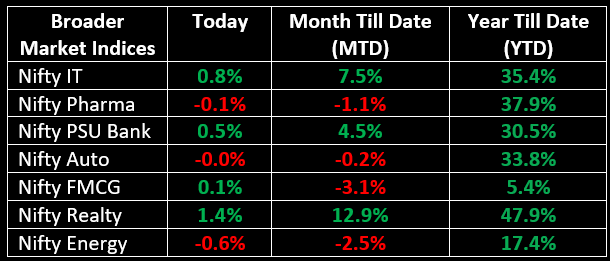

On the sectoral front, power, telecom, and media indices were down 0.5-1%, while IT, metal, PSU Bank, and realty indices gained 0.4-1%.

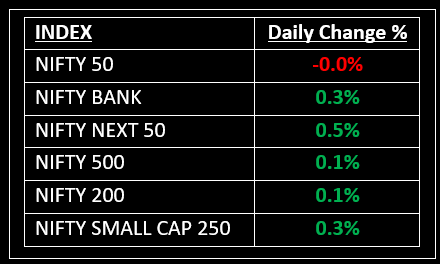

NIFTY: The index opened 33 points higher at 24,652 and made a high of 24,677 before closing at 24,610. Nifty has formed a bearish candlestick pattern with a long lower shadow, resembling a Bullish Hammer kind of pattern on the daily chart. Its immediate resistance level is now placed at 24,680 while immediate support is at 24,500.

BANK NIFTY: The index opened 43 points higher at 53,450 and closed at 53,577. Bank Nifty has formed a bullish candlestick pattern with a lower shadow on the daily chart. Its immediate resistance level is now placed around 53,800 while immediate support is around 53,300.

Stocks in Spotlight

▪ Glenmark Pharma: Stock surged over 4% after the company stated that the first clinical data of its blood cancer drug showed a positive response rate of 83%.

▪ Religare Enterprises: Stock jumped nearly 10% intraday after the Reserve Bank of India (RBI) cleared Burman family's open offer to acquire an additional 26% stake in the company.

▪ Indraprastha Gas: Stock gained over 2% as the board of the company approved a 1:1 bonus issue.

Global News

▪ European markets traded lower on Tuesday, retreating from yesterday’s positive trading session as investors geared up for the latest U.S. inflation report this week.

▪ Oil prices eased on Tuesday, retaining most of their gains from the prior session, as mounting geopolitical risks following the fall of Syrian President Bashar al-Assad and China’s vow to ramp up policy stimulus provided support for prices.

▪ The dollar rose on Tuesday ahead of U.S. inflation data that could offer clues about the Federal Reserve’s monetary-easing path, while analysts assess the likely impact of President-elect Donald Trump’s policies when he begins his second term.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.