POST-MARKET SUMMARY 08 January 2024

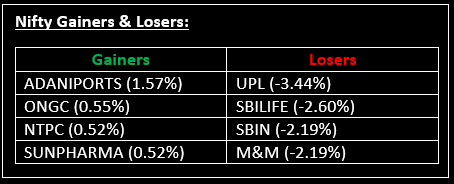

On January 8, the domestic equity benchmarks fell ~1% each amid weak global cues. The nervousness preceding the Q3 earnings season and profit-booking contributed to this downturn. Top Gainer: ADANIPORTS | Top Loser: UPL

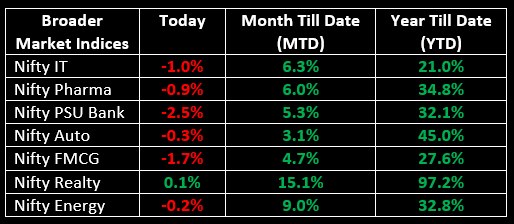

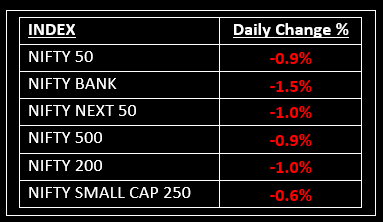

On January 8, the domestic equity benchmarks fell ~1% each amid weak global cues. The nervousness preceding the Q3 earnings season and profit-booking contributed to this downturn. The major drags on the market included banks, financial services, and FMCG. The Nifty concluded the day at 21,513, down 197.80 points or 0.91%. Except for Nifty Media and Nifty Realty, which saw marginal gains of about 0.1% each, all other sectoral indices ended with losses. Nifty FMCG emerged as the most significant loser, registering a decline of 1.72%. Following closely, Nifty Bank witnessed a 1.47% fall, while Nifty Financial Services dropped by 1.03%.

NIFTY: The index opened 37 points higher at 21,747 and made a high of 21,764 before closing at 21,513. Nifty has formed a big bearish candle on the daily chart. Its immediate resistance level is now placed at 21,600 while immediate support is at 21,475.

BANK NIFTY: The index opened 63 points lower at 48,096 and closed at 47,450. Bank Nifty has formed a bearish marubozu candle with significant volumes on the daily chart. Its immediate resistance level is now placed at 47,600 while support is at 47,400.

Stocks in Spotlight

▪ Honasa Consumer: Stock surged 6.4% following a block deal, with 32.60 lakh shares worth Rs 142 crore changing hands on the exchanges.

▪ Godrej Industries: Stock jumped over 5% after the company signed a non-binding MoU with the Gujarat government to invest Rs 600 crore.

▪ Jupiter Wagons: Stock gained 2.7% after the company received a Rs 100-crore order from an automobile manufacturer.

Global News

▪ Gold prices fell on Monday as fading expectations of an early rate cut in the U.S. kept the dollar and bond yields supported, ahead of a key inflation print due later this week.

▪ Oil prices fell over 2% on sharp price cuts by top exporter Saudi Arabia and a rise in OPEC output, offsetting supply concerns generated by escalating geopolitical tension in the Middle East.

▪ The dollar held on to most of last week’s gains on Monday after posting its biggest weekly rise against a basket of other major currencies since July, putting a halt to the declines seen in late 2023.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.