POST-MARKET SUMMARY 08 December 2023

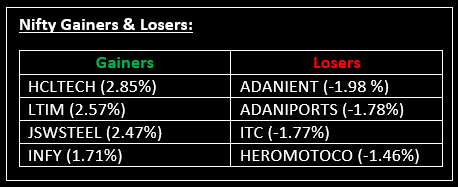

On December 8, the benchmark indices continued their upward trajectory,reaching new highs. This positive momentum was fuelled by the Reserve Bank of India (RBI) keeping the key interest rate unchanged Top Gainer: HCL Tech | Top Loser: Adani Enterprise

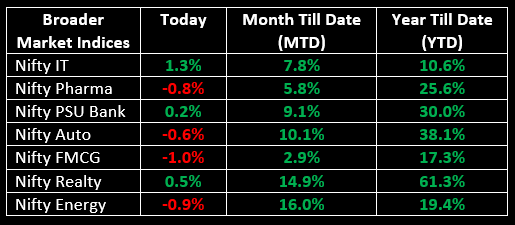

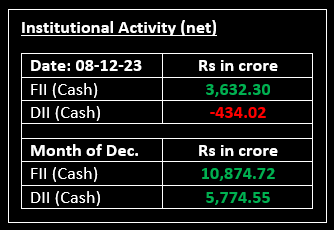

On December 8, the benchmark indices continued their upward trajectory, bouncing back from a brief pause the previous day, reaching new highs. This positive momentum was fuelled by the Reserve Bank of India (RBI) keeping the key interest rate unchanged for the fifth consecutive time. On the sectoral front, the FMCG, oil & gas, and power indices experienced a 1% decline each, while healthcare and auto slipped 0.5%. Conversely, the banking, information technology, and realty sectors recorded gains of 0.5-1%.

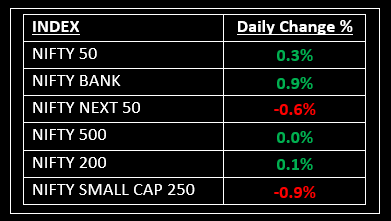

NIFTY: The index opened 33 points higher at 20,934 and made a high of 21,006 before closing at 20,969. Nifty has formed a bullish candlestick pattern with upper and lower shadow. Its immediate resistance level is now placed at 21,000 while immediate support is at 20,850.

BANK NIFTY: The index opened 44 points lower at 46,797 and closed at 47,262. Bank Nifty has formed a healthy bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,400 while support is at 46,800.

Stocks in Spotlight

▪ IRB Infra: Stock gained 3.6% after the company reported a 20% rise in gross toll collections in November.

▪ Jindal Saw: Stock plunged 3.8%, ahead of the company’s board meeting on December 14 to consider the proposal of raising funds through one or more qualified institutional placement (QIP) of equity shares.

▪ IIFL Securities: Stock surged 4.2% after the Securities Appellate Tribunal (SAT) set aside SEBI’s order dated June 19, 2023, prohibiting IIFL Securities from onboarding new clients for two years in respect of its business as a stockbroker.

Global News

▪ Gold prices were flat on Friday, as markets looked forward to the crucial US jobs data for more clues on the Federal Reserve’s monetary policy decision, although a firmer dollar kept bullion on track for its first weekly fall in four.

▪ European markets held in positive territory on Friday afternoon, as traders around the world assessed the November jobs report from the US.

▪ Oil benchmarks were headed for a seventh straight weekly decline on worries over a global supply surplus and weak Chinese demand, although prices recovered ground on Friday after Saudi Arabia and Russia called for more OPEC+ members to join output cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.