POST-MARKET SUMMARY 07 November 2023

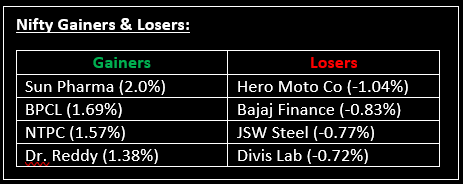

On November 7, the Indian equity indices faced a marginal dip in a session characterized by volatility, after enjoying three consecutive positive trading sessions. The market maintained a rangebound trajectory throughout the day. Top Gainer: Sun Pharma | Top Loser: Hero Moto Co

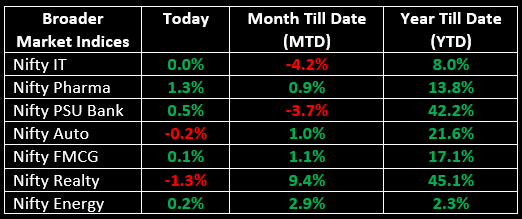

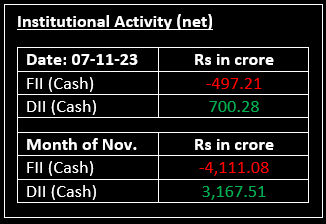

On November 7, the Indian equity indices faced a marginal dip in a session characterized by volatility, after enjoying three consecutive positive trading sessions. Despite an initial lower start influenced by mixed global cues, the market maintained a rangebound trajectory throughout the day. However, a last-hour surge in buying activity managed to offset some of the losses, resulting in a flat closure. In terms of sectoral performance, healthcare and oil & gas witnessed a 1% rise each while realty experienced a 1% decline.

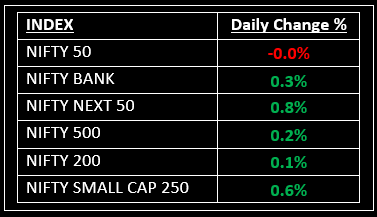

NIFTY: The index opened flat at 19,404 and made a high of 19,423 before closing at 19,406. Nifty has formed a Doji kind of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 19,480 while immediate support is at 19,310.

BANK NIFTY: The index opened flat at 43,598 and closed at 43,737. Bank Nifty has formed a bullish candlestick pattern with a long lower shadow on the daily chart. Its immediate resistance level is now placed at 43,835 while support is at 43,500.

Stocks in Spotlight

▪ HPCL: Stock gained 6.5% after the oil refining PSU registered a consolidated net profit of Rs 5,826.96 crore for the second quarter of 2023-24.

▪ Som Distilleries: Stock tanked over 10% after reports of an income tax search operation at the company premises.

▪ Gujarat State Petronet: Stock jumped 2.35% post registering robust profit growth of 36% on a QoQ basis to Rs 590 crore.

Global News

▪ South Korean stocks fell 2%, leading losses in the wider Asia-Pacific region as investors parse trade data coming out of China, as well as a rate hike by the Reserve Bank of Australia.

▪ Oil prices hit fresh 2½-month lows on Tuesday as mixed economic data from China offset the impact of Saudi Arabia and Russia extending output cuts.

▪ Gold fell to a near two-week low on a firmer dollar, with traders positioning for interest rate cues from a host of Federal Reserve speakers this week.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.