POST-MARKET SUMMARY 05 December 2023

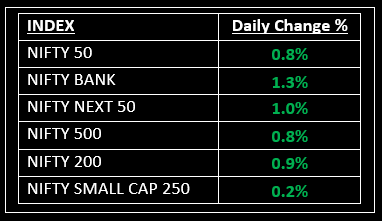

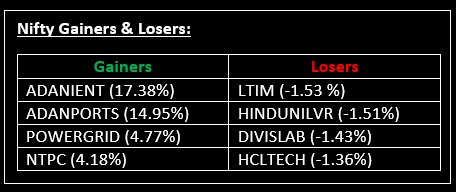

On December 5, the record-breaking rally continued into its second day as the market extended its winning streak for the sixth consecutive session, with Nifty comfortably closing above the 20,800 mark. A mixed trend was observed on the sectoral front. Top Gainer: Adani Enterprise | Top Loser: LTIM

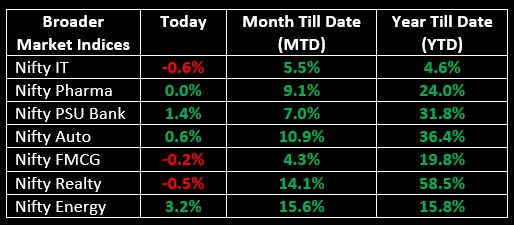

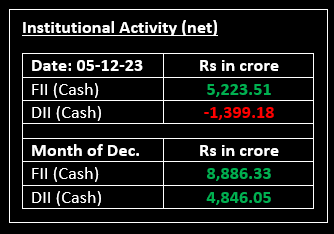

On December 5, the record-breaking rally continued into its second day as the market extended its winning streak for the sixth consecutive session, with Nifty comfortably closing above the 20,800 mark. A mixed trend was observed on the sectoral front, with the Power index surging by 6%, the oil & gas index gaining nearly 2%, and the Bank index increasing by 1%. Conversely, the Information Technology and Realty indices witnessed a decline of 0.5% each.

NIFTY: The index opened 122 points higher at 20,808 and made a high of 20,864 before closing at 20,855. Nifty has formed a bullish candlestick pattern with a long lower shadow on the daily chart, with higher highs and higher lows for six days in a row. Its immediate resistance level is now placed at 20,900 while immediate support is at 20,700.

BANK NIFTY: The index opened 464 points higher at 46,895 and closed at 47,012. Bank Nifty continued its higher high and higher low pattern for eighth straight session, forming a bullish candlestick pattern with long upper & lower shadow on the daily scale. Its immediate resistance level is now placed at 47,240 while support is at 46,475.

Stocks in Spotlight

▪ Adani Green Energy: Stock jumped 20% and got locked in the upper circuit after the company announced that it secured an additional $1.36 billion in funding via a senior debt facility.

▪ Brigade Enterprises: Stock gained 5% intraday after the company signed a joint development agreement with landowners to develop a luxury residential project spread over 4 acres in Mysuru in Karnataka.

▪ M&M Financial Services: Stock slipped 2.7% even though the company said its disbursement had grown 16% year-on-year to Rs 5,300 crore in November.

Global News

▪ The US dollar regained some ground on Tuesday and hovered near a one-week high.

▪ Asia-Pacific markets fell across the board as investors assessed a slew of economic data from across the region. Hong Kong’s index tumbled 2.07% in its final hour to its lowest since November 2022.

▪ Oil prices climbed on Tuesday, lifted by uncertainty over voluntary output cuts by the OPEC+ group of producers, tensions in the Middle East and some encouraging economic signals in Europe.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.