POST-MARKET SUMMARY 04 July 2023

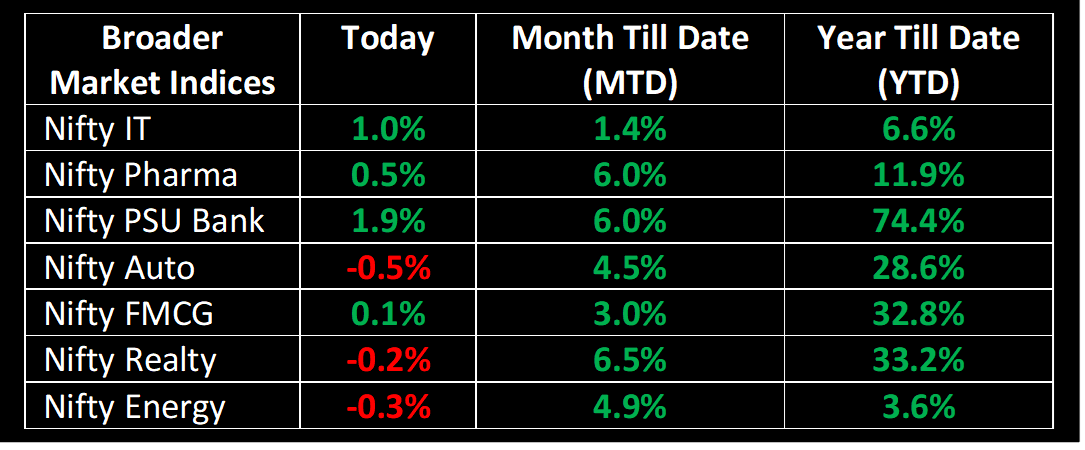

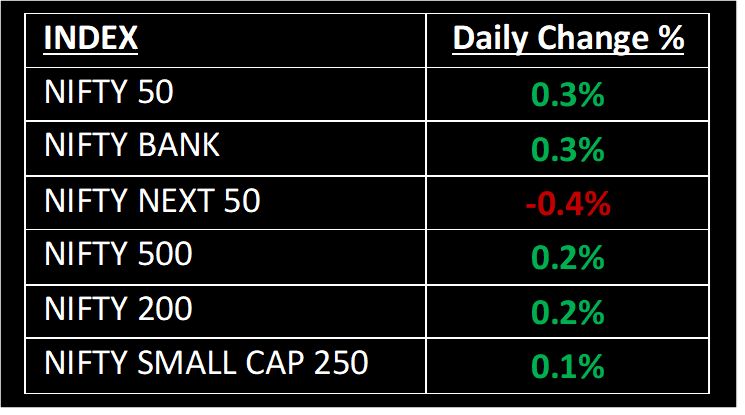

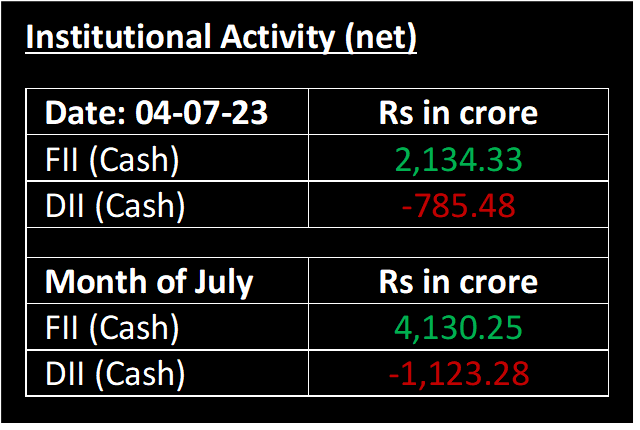

Despite weak global cues, Indian benchmark indices defied volatility and managed to inch higher for the sixth consecutive day, capitalizing on the renewed momentum in the market. The positive sentiment on Dalal Street was further bolstered by foreign inflows and optimistic business updates for the first quarter. The market's resilience was evident as the benchmark indices reached new record levels, disregarding the mixed cues from Asian markets and the weakness observed in early European trades.

NIFTY: The index opened 84 points higher at 19,406 and made a high of 19,434 before closing at 19,389. Nifty has formed a Hanging Man kind of pattern formation on the daily chart. This pattern appears after or during an uptrend. Its immediate resistance level is now placed at 19,450 while immediate support is at 19,300.

BANK NIFTY: The index opened 152 points higher at 45,310 and closed at 45,301. Bank Nifty has formed a High Wave Doji candlestick pattern with long upper and lower shadows on the daily chart, indicating indecisiveness among bulls and bears about the future market trend. Its immediate resistance level is now placed at 45,650 while support is at 44,800.

Stocks in Spotlight

▪ NBCC Ltd: Stock gained 2.2% after the company announced the signing of a MoU with Currency Note Press (CNP) under Security Printing and Minting Corporation of India Ltd.

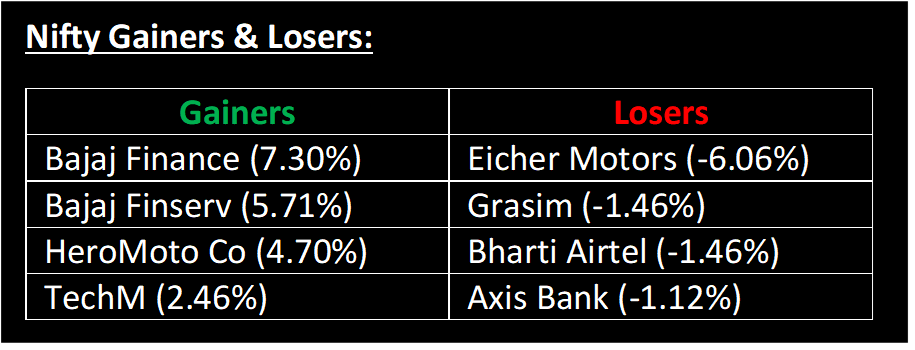

▪ Bajaj Finance: Stock surged 7% as the company reported upbeat numbers for the quarter ended June 2023. The customer franchise as of June 30 stood at 72.98 MM as compared to 60.30 MM as of 30 June 2022.

▪ Eicher Motors: Stock slipped over 6% after competitor Hero Moto Corp, along with Harley Davidson, announced launch of X440 in India.

Global News

▪ Asia-Pacific markets were mixed as investors further assessed the Reserve Bank of Australia’s decision to hold its rates steady at 4.10%.

▪ China has announced export restrictions on some gallium and germanium products, metals used in computer chips and other products, citing national security interests.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.