POST-MARKET SUMMARY 03 July 2023

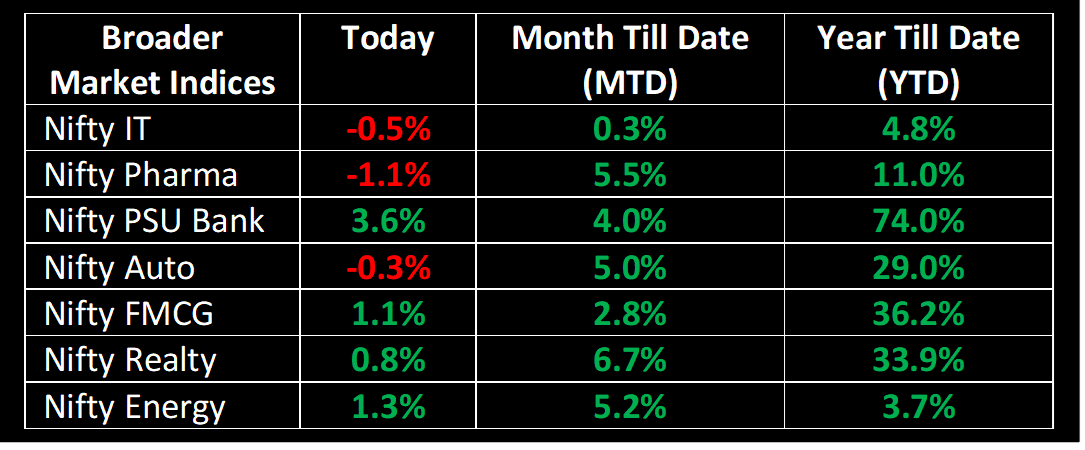

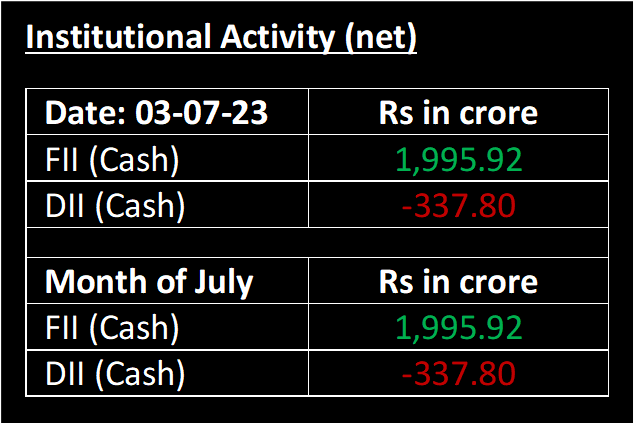

The market maintained its upward trend and began the month of July with considerable strength, with key benchmark indices reaching new all-time highs on July 3. This surge was primarily driven by the performance of sectors such as metal, oil & gas, and financials. The overall bullish momentum can be attributed to the positive impact of robust June GST collections, widespread monsoon coverage across the country in recent days, significant inflows of foreign funds, and India's strong performance across various economic indicators.

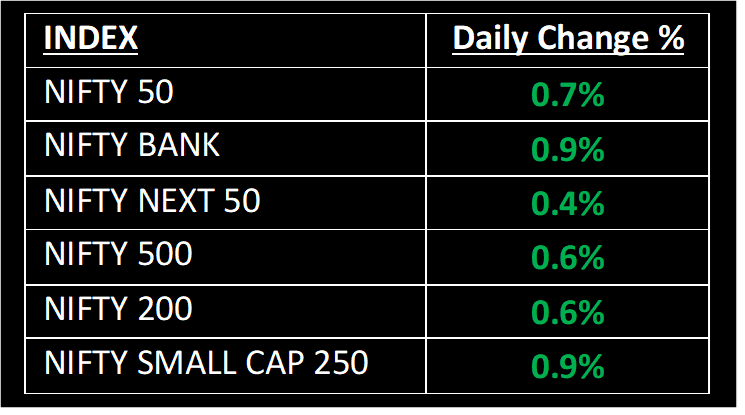

NIFTY: The index opened 57 points higher at 19,246 and made a high of 19,345 before closing at 19,322. Nifty has formed a bullish candlestick pattern on the daily chart, making higher highs and higher lows for the 4th consecutive day. Its immediate resistance level is now placed at 19,450 while support is at 19,000.

BANK NIFTY: The index opened 210 points higher at 44,957 and closed at 45,158. Bank Nifty has formed a bullish candlestick pattern with a long upper shadow and a small lower shadow on the daily chart. Its immediate resistance level is now placed at 45,500 while support is at 44,500.

Stocks in Spotlight

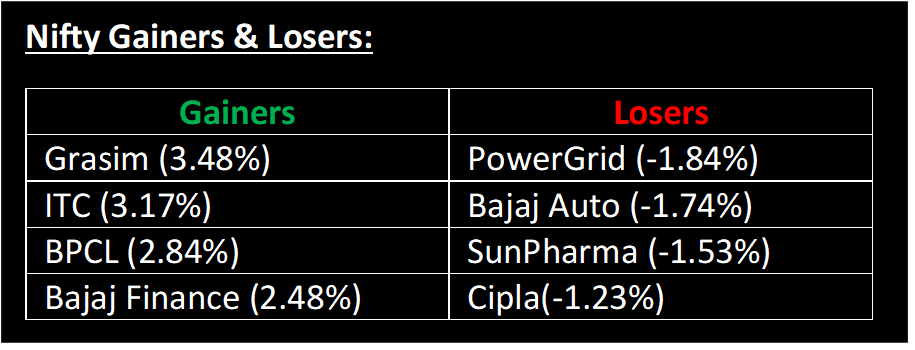

▪ Mahindra & Mahindra Ltd: Stock gained 1% after the company reported a 21% increase in domestic passenger vehicle sales at 32,588 units in June 2023 over last year.

▪ Mazagon Dock Shipbuilders: Stock gained nearly 8% in early trade to hit a 52-week high of Rs 1,342 after the company signed a contract worth Rs 2,725 with the Ministry of Defence

▪ BSE Ltd: Stock rallied over 10% after its board announced a possible buyback on July 6, according to a filing with the National Stock Exchange.

Global News

▪ European stock markets climbed Monday after closing the first half of the year 8.8% higher.

▪ Saudi Arabia and Russia, the largest oil exporters, increased oil production cuts, leading to higher prices amid global economic concerns and potential US Federal Reserve interest rate hikes.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.