PKH Ventures IPO Opens Today: Should You Subscribe?

Explore an in-depth analysis of PKH Venture’s IPO, weighing its potential growth, valuation, risks and investment opportunities.

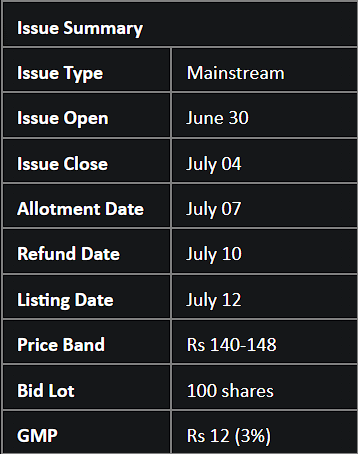

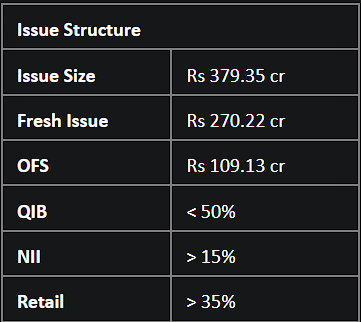

PKH Ventures Ltd, a civil construction firm, has launched its initial public offering (IPO) with a price band of Rs 140-148 per share. The IPO consists of a new issue of 1.82 crore equity shares, along with an offer for sale (OFS) of 73.73 lakh shares by promoter Pravin Kumar Agarwal. With the fresh issue expected to generate Rs 270.22 crore at the top price band and the OFS projected to yield Rs 109.13 crore, the total value of the PKH Ventures IPO amounts to Rs 379.35 crore. The subscription period for this IPO concludes on July 4.

The company proposes to allocate the fresh issue proceeds of Rs 124.12 crore to its subsidiary, Halaipani Hydro Project, to foster the development of hydroelectric projects. It will use Rs 80 crore to fund the long-term working capital requirements of its subsidiary - Garuda Construction. In addition, the Mumbai-based firm intends to allocate Rs 40 crore towards pursuing inorganic growth via acquisitions and other strategic ventures.

ABOUT PKH VENTURES

PKH Ventures, over a span of 18 years, has proven itself as a multifaceted entity in construction, development, hospitality, and management services. The company has a track record of successfully managing over 15 airports across India, from overseeing restaurants, bars, food stalls, and lounges to administering parking spaces and ticket counters. Furthermore, it boasts construction of more than 15 lakh square feet in various private and government projects.

COMPETITIVE STRENGTHS

PKH Ventures' profit margins have significantly improved in recent times. The Profit After Tax (PAT) margin notably increased from 11.55% in FY21 to 16.51% in FY22, finally reaching 18.47% as of December 2022. The EBITDA margin also witnessed a positive trend, rising from 29.71% to 41.71% over the same period.

The company has a healthy order book with Rs 468 crore worth of construction/development orders in hand, which provides clear revenue visibility.

RISK FACTORS

However, it is important for investors to weigh the potential risks before jumping on board. The company's debt has seen a substantial rise, reaching around Rs 138 crore for the nine months ending 31 December 2022, in stark contrast to the Rs 48.6 crore recorded in FY22.

It is also worth noting that some financial metrics have been on a downturn. FY22 saw a 17.5% decrease in Revenue from Operations and a drop in Return on Net Worth (RoNW) to 12.4% from 16.6% in FY21. Additionally, while its construction and development business has grown over the last three fiscal years, the company's management services sector has faced a considerable drop.

VERDICT: AVOID

Despite its growth in profit, the company has presented a few concerning financial trends such as a decrease in Revenue from Operations and Return on Net Worth. In addition to this, the debt of the company has been increasing.

From a valuation perspective, the IPO seems to be aggressively priced at a PE multiple of 32x based on FY23 earnings. The grey market premium (GMP), a valuable indicator of investor sentiment, also hints at a flat listing.

All things considered, we do not foresee significant gains due to the average fundamentals of the company. Its financial track record isn't convincing enough for long-term investment. We suggest keeping an eye on the company's performance over the next few quarters before making any investment commitments.

If you're seeking smarter investment opportunities and real-time insights to make informed decisions, consider exploring Liquide. With powerful features like LiMo, an AI-powered bot providing expert recommendations, Liquide empowers you to navigate the market with confidence. Stay updated on the latest news, track your portfolio, and gain access to expert trade setups. Download the Liquide app from the Google Play Store or Google Play Store today and experience a seamless investment journey. Don't miss out on the chance to optimize your investments and maximize your returns.