Power Finance Corporation Q2 Results: Net Profit Climbs 9%; Revenue Up 15%

Power Finance Corporation’s impressive Q2FY25 results, including a robust growth in revenue and net profit, lead to a 7% surge in stock price. Get detailed insights and investment guidance with Liquide.

Stocks in News | Shares of state-owned Power Finance Corporation Ltd (PFC) jumped over 7% on Monday (November 11), following their stellar second-quarter results. The firm’s net profit climbed 9% year-on-year, reaching Rs 7,215 crore, up from Rs 6,628.2 crore in the year-ago quarter.

PFC: Q2 Financial Highlights

- Revenue Growth: Revenue from operations jumped over 15% to Rs 25,721.8 crore from Rs 22,374.6 crore in the corresponding quarter of the previous year.

- Growth in Loan Assets: The consolidated loan asset book grew by 13%, expanding from Rs 923,724 crore as of September 30, 2023, to Rs 1,039,472 crore by the end of September this year.

- Reduction in Net NPA: The consolidated Net NPA decreased to its lowest at 0.80% in the first half of FY25, down from 0.98% in the same period last year.

- Significant Decrease in Gross NPA: The Gross NPA also saw a substantial reduction, decreasing by 78 basis points from 3.4% in the first half of FY24 to 2.62% in H1 FY25.

Dividend Details & Record Date

In recognition of the company's positive financial health, the board has declared a second interim dividend of Rs 3.50 per equity share.

The record date to determine the eligibility of shareholders for this dividend has been set for November 25, 2024. The payment or dispatch of this dividend will occur on or before December 8, 2024.

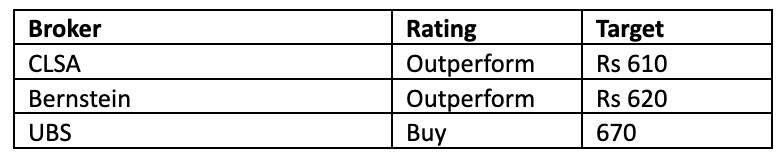

Brokerage Outlook for PFC

Following this performance, several brokerages have issued bullish calls on the stock.

About Power Finance Corporation Ltd

Power Finance Corporation Ltd, established on July 16, 1986, is classified as a Schedule-A Maharatna CPSE and stands as the largest Non-Banking Financial Corporation (NBFC) in India in terms of net worth, including all reserves. It operates as a specialized financial institution in the power sector, holding a dominant position with approximately 20% market share.

Expert Stock Investment Advice with LiMo

Should you buy PFC shares at current levels? For those seeking expert guidance on stock investments, LiMo, the world's first AI copilot for stock investing, is available exclusively through Liquide. LiMo provides detailed analyses, judgment, and actionable insights based on technical indicators to guide you on when to enter and exit trades.

Start your Investment Journey with Liquide

For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions. Download the Liquide App now and embark on a journey of informed and successful investing.