Weekly Recap: Top Stocks, Market Insights & Next Week's Outlook

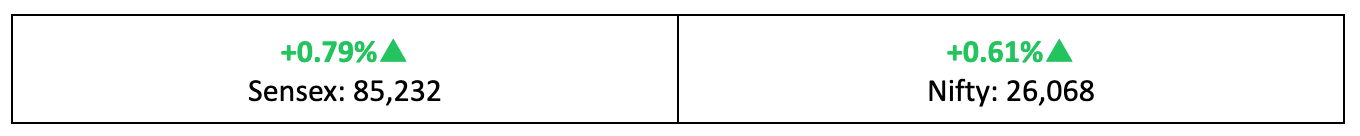

Markets gained for the second consecutive week, with Nifty rising 0.6%. While large-cap stocks showed resilience, broader indices lagged. Here’s a recap of the week's market performance and what lies ahead.

Markets gained for the second consecutive week, with Nifty rising by 0.6% compared to last Friday. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Moving Forward

- Indian equity indices maintained their upward momentum for the second consecutive week, with Nifty rising 0.6% from last Friday.

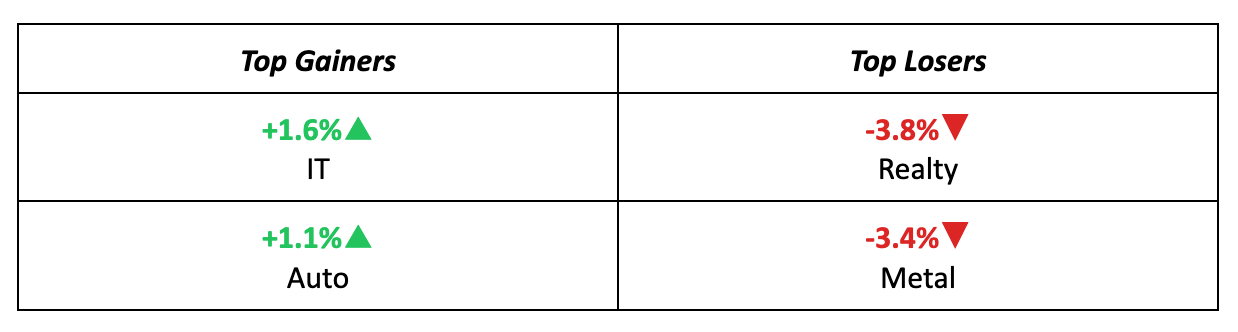

- However, broader indices lagged, with the BSE Large-Cap index posting modest gains, while the BSE Mid-Cap and BSE Small-Cap indices declined by -1% and -2%, respectively.

- Investor sentiment took a hit as the India VIX surged by over 14%, reflecting growing concerns amid both global and domestic uncertainties.

The Big Stories

- Global cues were mixed last week, with uncertainty over a potential Fed rate cut due to strong US payroll data and concerns about a tech bubble, though NVIDIA’s strong results provided some relief.

- At home, delays in the US-India trade deal, a weakening rupee and soft PMI data weighed on markets, but these were offset by resilient corporate earnings, which supported investor sentiment.

The Winners

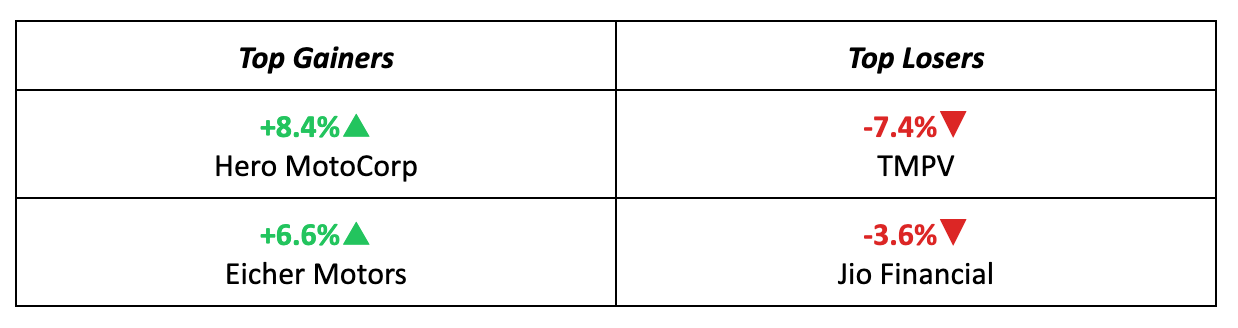

- Hero MotoCorp was the top performer of the week, surging 8.4% after Macquarie and J.P. Morgan upgraded the stock, citing strong growth in electric two-wheelers, stable margins and potential market share gains.

- Eicher Motors followed closely, rising 6.6% as analysts turned bullish on the stock following its solid second-quarter performance, which extended its growth momentum.

The Losers

- Tata Motors Passenger Vehicles fell 7.4%, becoming the biggest laggard after posting one of its worst financial performances in recent times, primarily due to weak JLR results, despite stable performance in the India PV business.

- Jio Financial Services slipped 3.6%, as strong underlying growth was overshadowed by the stock trading below key technical support levels, triggering short-term selling pressure.

Meanwhile

- U.S. non-farm payrolls rose by 1,19,000 in September, reversing the August decline of 4,000 and exceeding expectations, signalling resilience in the labour market and potentially reducing hopes for near-term Fed rate cuts.

- In India, the November PMI showed a decline, with manufacturing output weakening sharply, while services activity picked up. Private sector activity hit a six-month low.

Market Brief

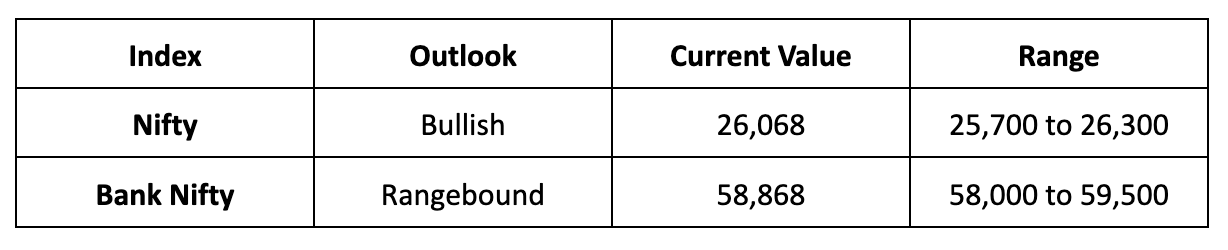

Market Outlook

Our Take

- Global sentiment towards India is improving, with major brokerages upgrading their market outlook due to signs of earnings recovery and favourable government reforms.

- Unless global cues turn sharply negative, we expect the bullish sentiment to extend into the coming week, with the Nifty likely to trade in the range of 25,700 to 26,300 for the week beginning 24th.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.