Nifty Extends Losses for 6th Week: Market Outlook, Top Gainers & Losers

Nifty falls for the sixth straight week amid global trade tensions and muted earnings. See top gainers, losers, sector trends and our market outlook for August 2025.

Weekly Recap

Markets fell for the sixth consecutive week, marking the longest losing streak in five years. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Continued Slump

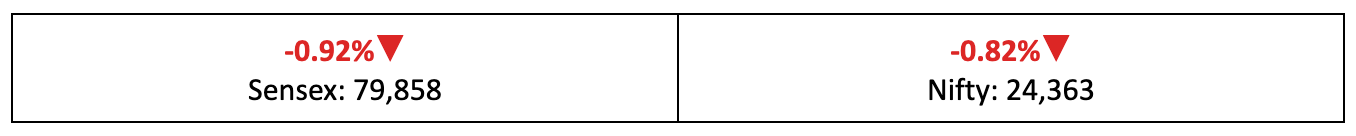

- The Nifty notched its sixth straight weekly decline with a 0.82% loss, its longest losing streak since the Covid-driven selloff of February–March 2020.

- Broader markets fared worse, with the BSE Midcap index down 1.3% and the BSE Smallcap index sliding 1.9% over the week.

- The India VIX rose for the second consecutive week, as nerves continued to run high on D-Street.

What’s Going On?

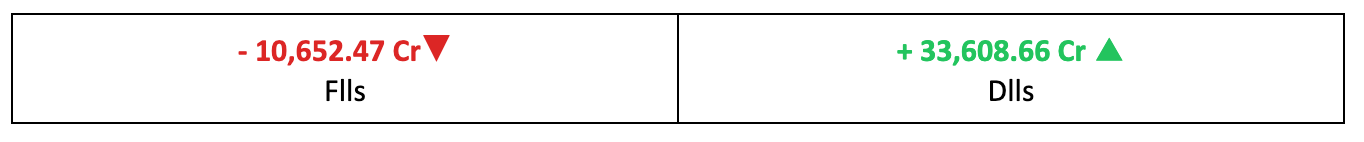

- India found itself in the crosshairs of the Trump administration last week, with a fresh round of tariff hikes pushing the total levy rate to 50%. The move added to market jitters already fuelled by sluggish corporate earnings growth and persistent foreign fund outflows.

- The RBI kept the repo rate unchanged at 5.5% in its latest monetary policy meeting, pointing to “evolving uncertainties” from factors such as the new tariffs. Also read: RBI Holds Rates Steady: Why That's a Smart Move

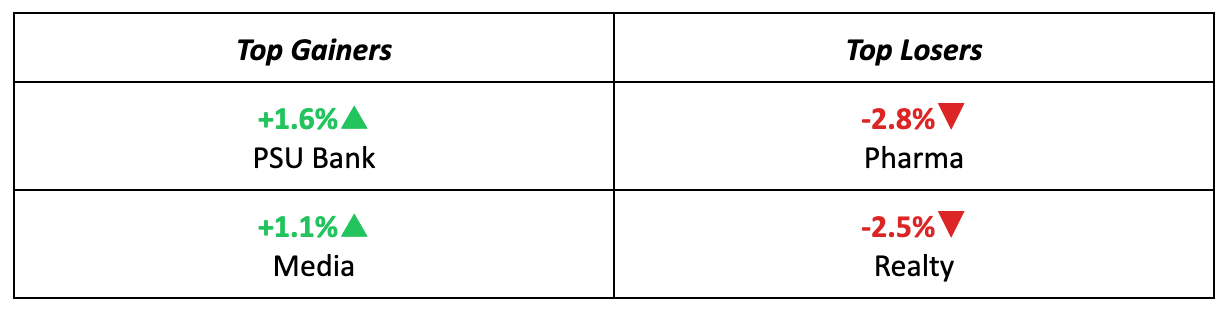

The Winners

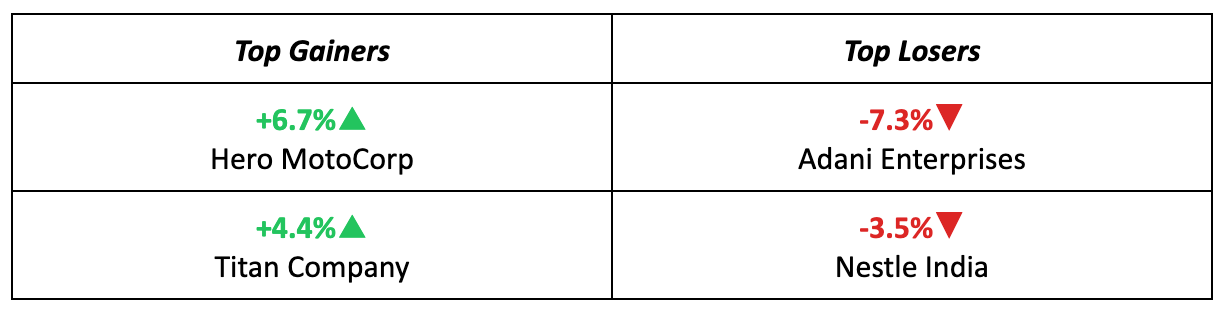

- Hero MotoCorp jumped 6.7% last week after reporting a stable demand environment and resilient margins despite a slight revenue dip.

- Titan Company gained 4.4% as robust Q1 PAT growth prompted several brokerages to raise price targets and issue fresh buy calls.

The Losers

- Adani Enterprises extended its slide, falling 7.3% after last week’s disappointing results, as weak market sentiment kept risk appetite for the stock muted.

- Nestlé India was the second-biggest laggard, down 3.5% for the week. On Friday, some platforms mistakenly showed a 50% plunge, which was simply the technical adjustment for its 1:1 bonus issue.

Meanwhile…

- The Bank of England cut interest rates by 25 bps in a narrow vote, signalling its view that inflation will remain a stubborn challenge.

- On Wall Street, rare bright spots came from AI-fuelled rallies in tech giants like Microsoft and Meta, both of which posted better-than-expected results.

Market Brief

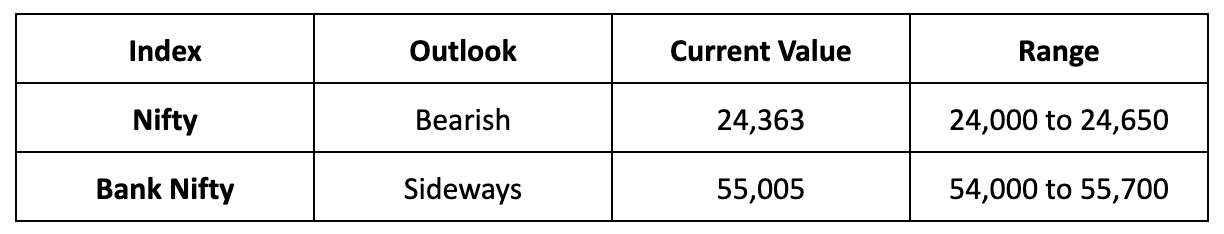

Market Outlook

Our Take

- With earnings and global policy shifts painting a mixed picture, we expect volatility to persist in the near term.

- Unless positive developments arise from trade deals, we expect the Nifty to trend bearish next week, forecasting a range between 24,000 and 24,650.

- Investors should keep a close watch on global trade developments and corporate earnings, while strategically positioning in domestic consumption-driven sectors that are relatively resilient to short-term market swings.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.