Weekly Recap: Nifty, Sensex Post Biggest Weekly Gain Since 2021

Nifty, Sensex soar over 4% in a powerful comeback week. See which stocks rallied, what sectors led, and where markets could head next.

Weekly Recap

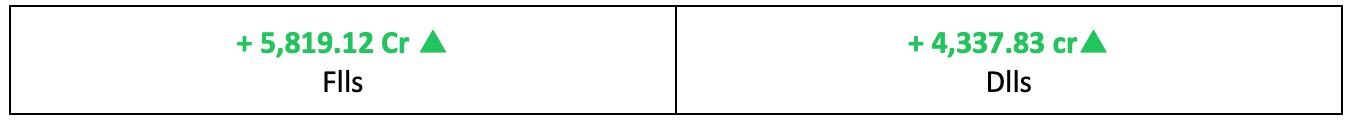

Markets posted their biggest weekly gain since February 2021, fuelled by sustained DII buying, FIIs returning as net buyers after 13 straight weeks, and a strengthening rupee. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Bulls take charge!

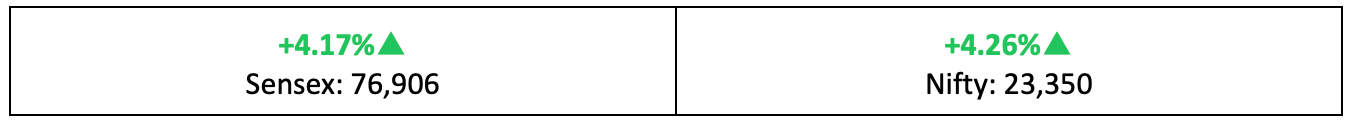

- Indices had a spectacular run last week, with the bulls charging through D-Street — the Nifty surged 4.26% over the previous Friday. Volatility eased across the board, with the India VIX slipping 5.3% over the week.

- The BSE Large-cap index climbed 4.6%, while the BSE Mid-cap index jumped 7%, marking its biggest weekly gain since February 2021. The BSE Small-cap index soared nearly 8%, its strongest performance since June 2020.

- Several factors have fuelled this sharp uptrend — from global cues to domestic momentum. We break it all down in our latest blog: Why are Nifty, Sensex rising.

The winners

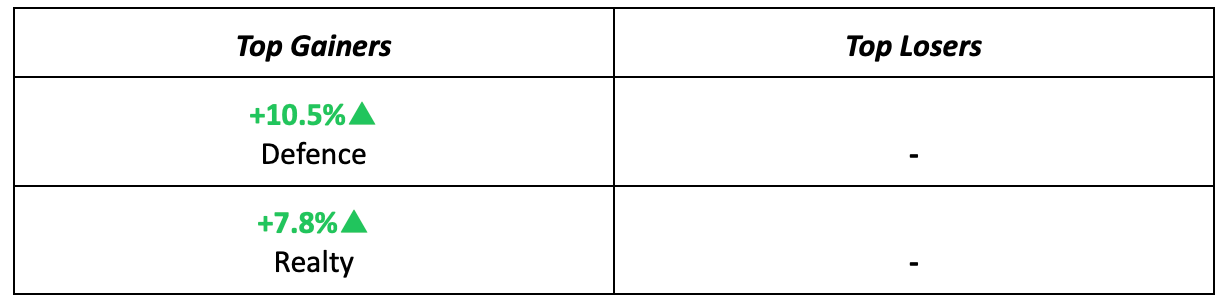

- The Defence sector emerged as the standout performer of the week, buoyed by the Defence Acquisition Council’s approval of capital acquisition proposals worth Rs 54,000 crore.

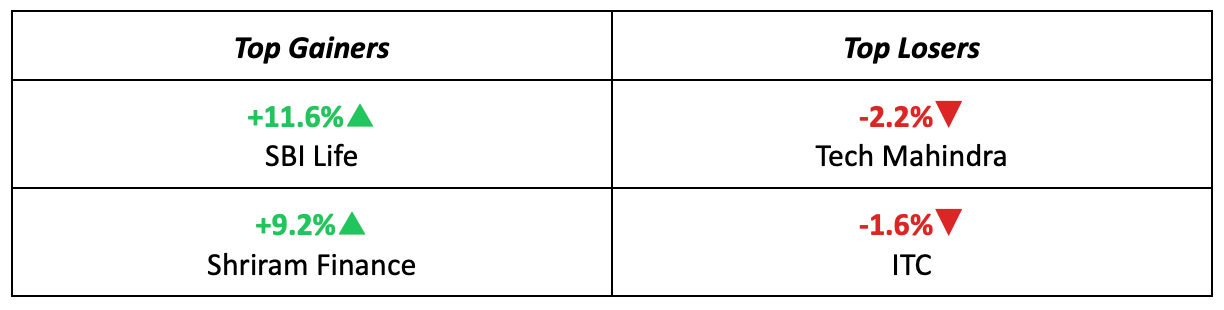

- SBI Life Insurance led the charts with a sharp 11.6% weekly gain, following its strategic investment in the not-for-profit Bima Sugam India Federation.

The losers

- Tech Mahindra and several other IT majors faced modest losses last week, driven largely by concerns over the Trump administration’s broad-based federal spending cuts.

- Sentiment was further dampened by Accenture’s trimmed guidance and lower order bookings for the upcoming quarter.

- That said, it’s worth noting that all sectoral indices managed to end the week in positive territory.

Meanwhile…

- The US Fed held rates steady last week, as did the Bank of England. This comes amid declining consumer confidence in the US economy and growing signs of weakening growth.

- Back home, after weeks of market corrections in 2025, the mutual fund industry saw a 4% dip in total assets under management (AUM)—from Rs 66.98 lakh crore in January to Rs 64.26 lakh crore in February.

- On a positive note, the Indian rupee had its strongest week in over two years, supported by a weakening US dollar index. The rupee appreciated by 103 paise, closing at 85.97/$ on March 21, up from 87/$ on March 13.

Brief

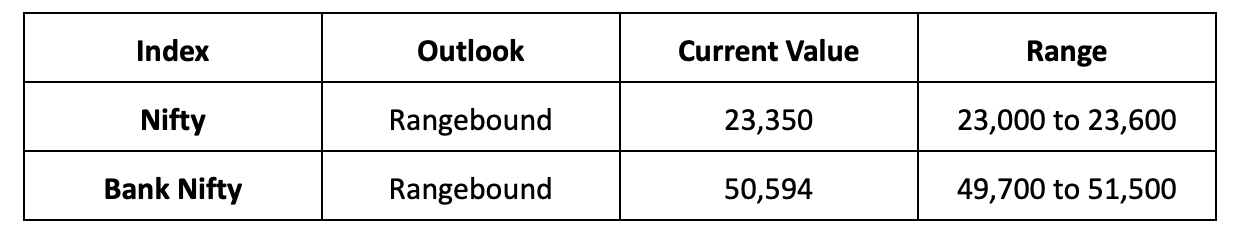

Key Indices

Sectors

Stocks

Other Key Data

Market Outlook

Sectors To Watch:

Our take

- Last week’s rally may have been a short burst of activity, but it brought much-needed relief to both retail and institutional investors.

- With market sentiment shifting quickly week to week, we expect the Nifty to consolidate in the coming days, likely within the 23,000 – 23,600 range.

- A decisive breakout above 23,600 could signal the next leg of the rally, while failure to sustain above 23,400 may result in continued near-term consolidation.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.