Nifty Conquers 20,000 Mark; What’s Next?

Delve into the factors driving Nifty's remarkable surge to 20,000 and discover what the future holds.

Introduction

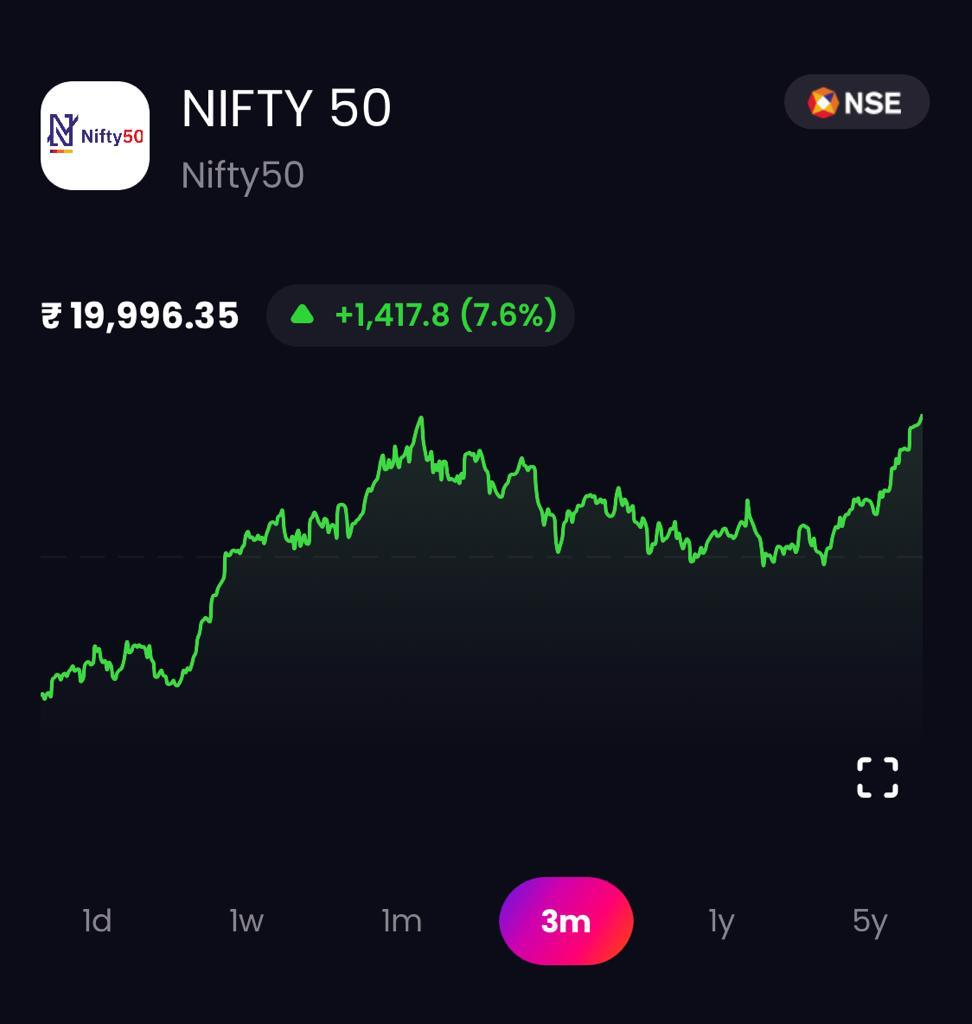

In a historic move, India's Nifty 50 index surged past the remarkable 20,000-point threshold on September 11, 2023, marking a significant milestone in the nation's stock market history. The Nifty wrapped up the day with a gain of 176.40 points, or 0.89%, at 19,996.35. Meanwhile, the Sensex ended the day up by 528.17 points or 0.79%, reaching 67,127.08.

This significant achievement was driven by several factors, including robust domestic macroeconomic data, resilient domestic institutional investments, and India's ability to withstand global uncertainties. The successful wrap-up of the G20 summit further uplifted investor confidence. Furthermore, India's engagement in 15 bilateral discussions at the summit's fringes underscores its growing stature on the world stage.

India's Impressive Economic Resilience

Despite global economic challenges and external pressures, India's economy has showcased remarkable resilience, with key indicators such as Goods & Services Tax (GST) collections, private capital expenditure, credit growth, and Purchasing Managers' Index (PMI) for August consistently demonstrating India's economic strength.

GST receipts for August 2023 saw a 11% YoY rise, amounting to Rs 1.59 lakh crore. The manufacturing PMI registered a 3-month peak at 58.6 in August. Additionally, the GDP growth for the June quarter shot up to 7.8% YoY. Such steadfastness has been pivotal in enhancing investor trust.

Steady Inflows

Since the start of April, the Nifty has seen a remarkable rally, fueled by inflows of over $18.9 billion. Domestic Institutional Investors (DIIs) bought Rs 33,397 crore during this period. Meanwhile, the mid- and small-cap indices have seen an even more substantial rally, each rising by about 41% and 47% respectively.

The data released today by AMFI indicates a Net Equity Inflow of Rs 20,161 crore in August (the highest in 5 months) vs. Rs 7,505 crore in July. Additionally, the SIP Inflows for August also reached a record high of Rs 15,814 crore.

What lies ahead

In the current market environment, valuations pose challenges, highlighting the criticality of prudent stock picking and effective risk management. A rising US dollar, increasing US bond yields, and concerns over potential interest rate hikes have raised red flags.

Having touched its all-time peak, the market might undergo some consolidation at these levels. However, the broader sentiment seems set to stay upbeat. Going forward, the market will be keenly eyeing the ECB's monetary stance, as well as inflation data from the US and India, set to be released later in the week.

Despite near-term headwinds, the longer-term perspective for the Indian market remains bullish given India's vigorous economic expansion, its dynamic corporate landscape, and ample domestic liquidity.

The Nifty 50's landmark surge beyond the 20,000-point barrier stands testament to India's enduring appeal as an investment hub. While there may be short-term hiccups, a staggered investment approach with astute asset distribution can aid investors in capitalizing on India's bright economic narrative.

Liquide's Stock Baskets can offer an effective way to invest in a diversified manner, especially during times of heightened market volatility or when valuations appear stretched. From comprehensive market analysis to personalized investment recommendations, Liquide offers a wealth of features to help you make informed decisions. Stay ahead of market trends, track your portfolio effortlessly, and explore detailed financial reports—all at your fingertips. Download Liquide now from the Google Play Store and Apple Appstore to embark on a journey toward financial success.