Weekly Recap: Geopolitical Tensions, Earnings & Market Outlook

Explore the key market movements of the week, including the impact of escalating geopolitical tensions and major earnings reports. Get the full breakdown, including top stock performers, losers and expert insights for the week ahead.

Markets had a bumpy week, closing largely flat amid geopolitical flares and key India Inc earnings. Here’s a look at the past week, a few stories you might have missed, and our take on what’s next, in your weekly report.

Choppy Trading

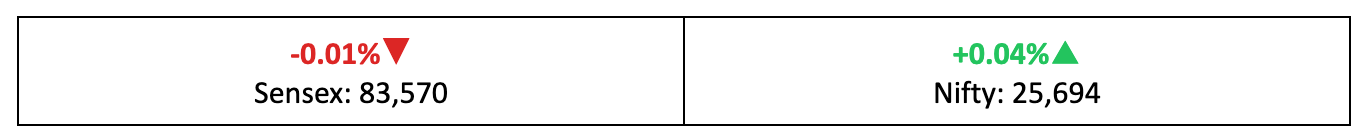

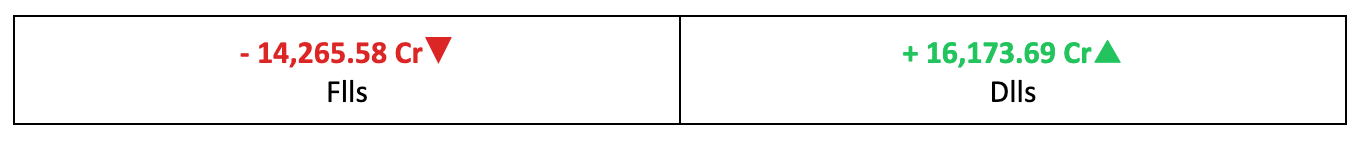

- Markets wrapped up a truncated week largely flat, dragged down by global trade uncertainties, escalating geopolitical tensions and persistent FII outflows.

- Broader indices showed mixed results: the BSE Midcap slipped 0.3%, Smallcap dipped 0.4%, while Largecap eked out a modest 0.15% gain.

- The India VIX, a measure of fear, jumped more than 4%, reflecting growing nervousness among investors due to geopolitical uncertainties.

The Big Stories

- Escalating US-Iran tensions, including protests, airspace closures and potential US military action, spurred safe-haven flows to Gold while capping equity gains.

- At the same time, the US Supreme Court's review of President Trump’s proposed tariffs (potentially up to 500%) has deepened trade worries, with no clear ruling in sight.

- Meanwhile, progress toward an India-EU free trade agreement (FTA), likely to be sealed later this month, provided a positive counterbalance, boosting sentiment.

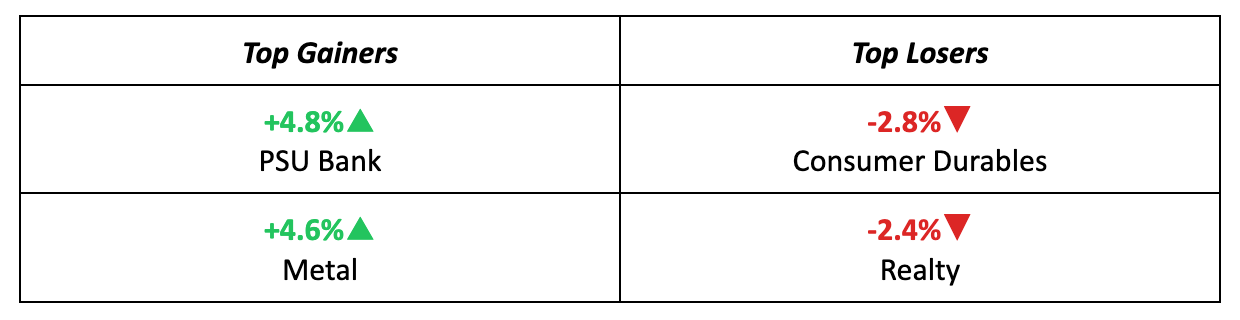

The Winners

- IndusInd Bank was a standout performer, up 8%, riding strong banking sector sentiment, supported by solid earnings reports from PSU Banks.

- Tech Mahindra also performed well, with a solid 5.6% gain, driven by better‑than‑expected quarterly results, strong deal wins and positive sentiment in the IT sector.

The Losers

- Cipla plunged nearly 5% after brokerage reports flagged earnings worries, citing supply disruptions in its key US product Lanreotide and intensifying competition in the generics market.

- L&T also struggled, losing 4.2%, amid news that Kuwait may scrap $8.7 billion in oil project tenders, threatening the engineering major's order pipeline.

Meanwhile

- Gold hit record highs amid escalating geopolitical tensions, particularly in Iran, and mounting concerns over US central bank independence, spurring strong safe-haven demand.

- The Indian rupee weakened further, sliding to 90.86 against the dollar on January 16 from 90.16 the previous week.

Market Brief

Market Outlook

Our Take

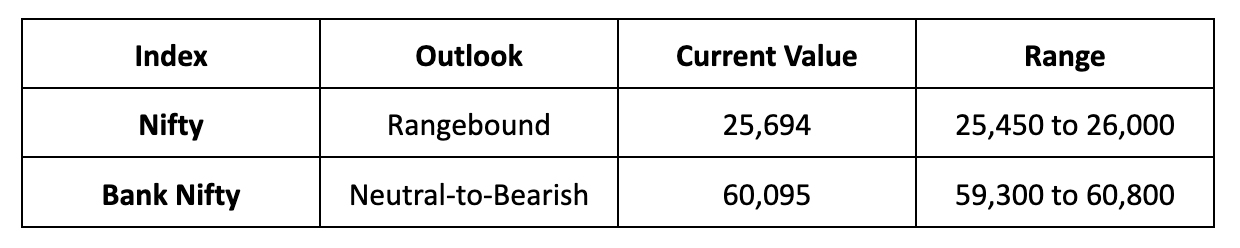

- With geopolitical risks escalating and trade uncertainties lingering, investors will likely stay on the sidelines, awaiting clearer signals.

- As a result, we expect the Nifty to stay rangebound next week between 25,450 and 26,000 levels, with stock-specific action driven by incoming earnings reports.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.