Liquide Post-Market Summary 6th October 2025

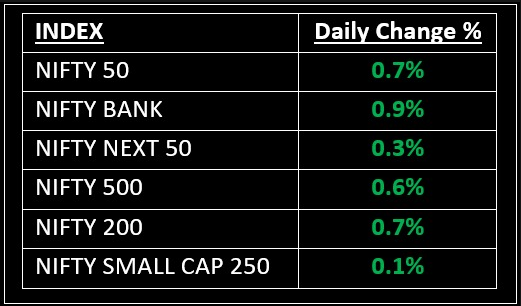

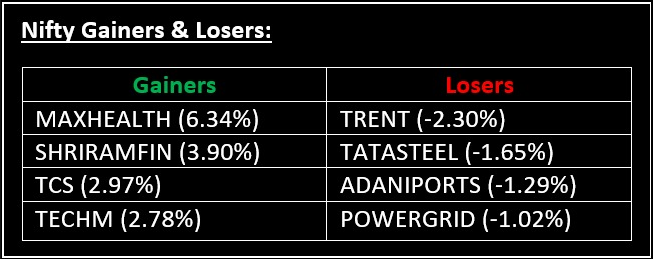

The stock market kicked off the week on a positive note, with the Nifty 50 extending its gains for the third consecutive session on October 6. It closed above the 25,000 mark, driven by strong performances in IT and financials. Top Gainer: MAXHEALTH | Top Loser:TRENT

The stock market kicked off the week on a positive note, with the Nifty 50 extending its gains for the third consecutive session on October 6. It closed above the 25,000 mark, driven by strong performances in IT and financials. The day saw initial gains followed by extended buying, taking Nifty 50 past 25,000 and settling near the day's high.

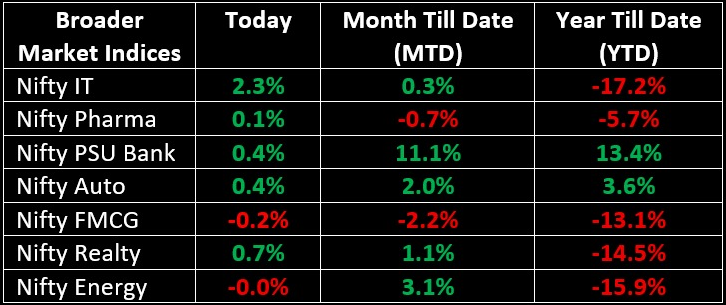

In the broader markets, the BSE Midcap index rose by 0.7%, while the Smallcap index underperformed, slipping by 0.2%. Among sectors, IT, Healthcare, Private Banks, Oil & Gas and PSU Banks gained between 0.4% and 2%. However, Metal, Media and FMCG sectors saw declines ranging from 0.2% to 0.9%.

In the primary market, Tata Capital launched India’s largest IPO of 2025, seeking to raise Rs 15,511.87 crore. For a detailed analysis of Tata Capital’s strengths, risks and valuation, check out our full review: Why Everyone’s Talking About Tata Capital’s IPO—Should You Jump In or Wait?

NIFTY: The index opened 22 points higher at 24,916 and made a high of 25,095 before closing at 25,077. Nifty has formed a long bullish candle on the daily chart. Its immediate resistance level is now placed at 25,150 while its immediate support is at 25,000.

BANK NIFTY: The index opened 245 points higher at 55,834 and closed at 56,104. Bank Nifty has formed a long bullish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed around 56,170 while immediate support is around 56,000.

Stocks in Spotlight

▪ JNK India: Stock hit the 10% upper circuit after the company secured a Rs 1,000+ crore ultra-mega contract from its Korean promoter, JNK Global.

▪ FSN E-Commerce Ventures: Stock jumped 6.5% following the company’s Q2 update, where management anticipates mid-20% revenue growth, driven by an early start to the festive season. The consolidated GMV is expected to grow close to 30%, up from the mid-20% range seen in recent quarters.

▪ Ceigall India: Stock rose over 2.5% after the company secured contracts worth Rs 712.16 crore and Rs 597 crore from Maharashtra State Electricity Distribution Company.

Global News

▪ Global equity markets displayed a mixed trend. Japan's Nikkei 225 soared nearly 5%, setting a new record high, while shares in France fell after its prime minister resigned less than a month after taking office.

▪ Oil prices rose more than 1% on Monday after OPEC+'s planned production increase for November was more modest than expected, easing some concerns over supply additions. However, a soft demand outlook is likely to cap near-term gains.

▪ Gold prices touched an all-time high, surpassing $3,900 per ounce, as investors sought safe-haven assets amid the U.S. government shutdown, broader economic uncertainty, and prospects of further Federal Reserve rate cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.