Liquide Post-Market Summary 5th December 2025

Equity benchmarks closed higher on Friday following the RBI's surprise decision to cut the repo rate by 25 bps and introduce liquidity measures aimed at supporting economic growth amidst rising US tariffs.

Equity benchmarks closed higher on Friday following the Reserve Bank of India's (RBI) decision to cut the repo rate by 25 bps to 5.25% and introduce liquidity measures aimed at supporting economic growth amidst rising US tariffs. This move took many by surprise, as market expectations were largely focused on the RBI maintaining rates due to historically low inflation and robust economic growth.

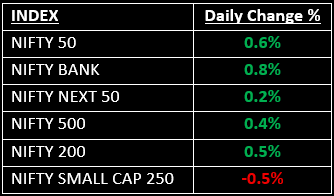

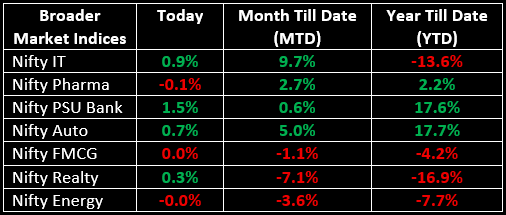

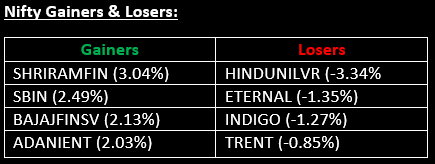

Among the broader indices, the BSE Midcap index gained 0.2%, while the BSE Smallcap index shed 0.7%. Sector-wise, Nifty Bank (+0.8%) and Financial Services (+0.9%) posted solid gains. The PSU Bank index surged by 1.5% and the Private Bank index rose by 0.5%. Nifty IT (+0.9%) and Auto (+0.7%) also recorded healthy gains.

NIFTY: The index opened 34 points lower at 25,999.80, reached a high of 26,202.60 and closed at 26,186.45. Nifty formed a long bullish candle on the daily chart. Its immediate resistance level is now placed at 26,250 while immediate support is at 26,100.

BANK NIFTY: The index opened 155.50 points lower at 59,133.20 and closed at 59,777.20. Bank Nifty also formed a bullish candle on the daily chart. Its immediate resistance level is now placed at 59,885 while immediate support is around 59,420.

Stocks in News

- Shriram Pistons & Rings: Stock surged over 8% following the announcement of its plans to acquire three companies for a combined enterprise value of €159 million (₹1,670 crore).

- Fineotex Chemical: Stock jumped 6% after the company revealed a strategic acquisition of the US-based CrudeChem Technologies Group through its subsidiary.

- PTC Industries: Stock rose more than 3% after its subsidiary, Aerolloy Technologies, signed a multi-year supply deal with Honeywell for aerospace castings.

Global News

- European shares steadied after three consecutive sessions of gains, positioning them for a weekly rise.

- Asian markets saw a mixed session, with the broader index excluding Japan dipping by around 0.1%, though still on track for a modest weekly gain.

- Oil prices remained steady, supported by stalled Ukraine peace talks, though gains were offset by expectations of a supply glut.

- Gold prices rose, bolstered by a weaker dollar and increasing expectations of a U.S. interest rate cut, as markets anticipate U.S. inflation data ahead of the Federal Reserve’s policy meeting next week.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.