Liquide Post-Market Summary 4th November 2025

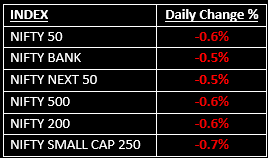

Indian equity indices closed lower on November 4, with Nifty ending below 25,600, as broad-based selling took place across sectors, except for consumer durables. Top Gainer: TITAN |Top Loser: POWERGRID

Indian equity indices closed lower on November 4, with Nifty ending below 25,600, as broad-based selling took place across sectors, except for consumer durables. The markets opened slightly higher on mixed global cues but struggled to maintain the momentum, slipping lower for the remainder of the session.

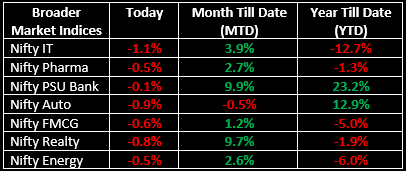

In the broader market, the BSE Mid-cap index fell by 0.3% and the BSE Small-cap index declined by 0.7%. Sector-wise, all sectors ended in the red except for Consumer Durables.

In the primary market, Groww, India’s largest and fastest-growing investment platform, launched its IPO today. For an in-depth review of its business model, strengths, risks and valuation, read our analysis here: India’s Largest Broking IPO: Groww’s Rs 6,600-Cr Offering — Subscribe or Avoid?

NIFTY: The index opened flat at 25,744 and made a high of 25,787 before closing at 25,597. Nifty has formed a long bearish candle with minor upper shadow on the daily chart. Its immediate resistance level is now placed at 25,700 while its immediate support is at 25,450.

BANK NIFTY: The index opened 50 points lower at 57,966 and closed at 57,827. Bank Nifty has formed a bearish candle with a minor upper shadow on the daily chart. Its immediate resistance level is now placed around 57,900 while immediate support is around 57,650.

Stocks in Spotlight

▪ DCW: Stock surged nearly 8% after the company reported a strong turnaround in Q2, swinging to a net profit of ₹13.8 crore, compared to a loss of ₹1.24 crore in the same period last year.

▪ Alembic Pharmaceuticals: Stock gained 4% following a 21% rise in Q2 net profit, which reached ₹185 crore, while revenue grew 16% YoY to ₹1,910 crore.

▪ Hero MotoCorp: Stock fell 4% after the company reported weak October auto sales. Total sales for the month dropped by 6.5%, from 6.79 lakh units last year to 6.36 lakh units.

Global News

▪ Asian and European markets nudged lower on Tuesday as investors aggressively booked profits following recent tech-driven rallies that had lifted stock prices to all-time highs.

▪ Oil prices dropped over 1%, pressured by OPEC+'s decision to pause output hikes for the first quarter of next year, along with weak manufacturing data and a stronger dollar.

▪ Gold prices trimmed earlier losses, supported by a pause in the dollar’s rally and lower Treasury yields. Investors are now awaiting U.S. economic data this week for further guidance on the interest rate outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.