Liquide Post-Market Summary 4th December 2025

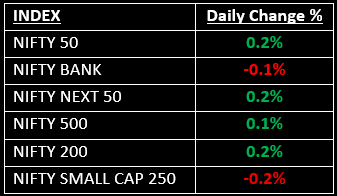

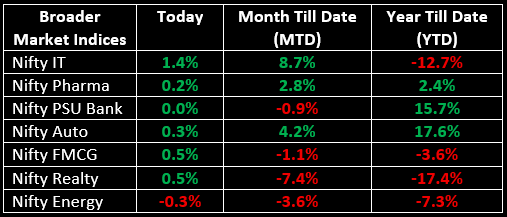

Equity benchmarks ended marginally higher on Thursday after a volatile session, with caution setting in ahead of the Reserve Bank’s Monetary Policy Committee (MPC) decision on Friday.

Equity benchmarks ended marginally higher on Thursday after a volatile session, with caution setting in ahead of the Reserve Bank’s Monetary Policy Committee (MPC) decision on Friday. The Nifty opened flat, edged higher initially, but later lost most of its gains as profit-booking in heavyweight stocks triggered sharp intraday swings. The rupee’s weakness also dampened overall market sentiment.

Among broader indices, the BSE Midcap index slipped 0.2%, while the BSE Smallcap index fell 0.3%. Meanwhile, in the primary market, Meesho's Rs 5,421.20-crore IPO was oversubscribed 8.27 times on Day 2. Dive deeper into why investors are rushing in: Could Meesho’s IPO Be Your Next Big Investment Opportunity?

NIFTY: The index opened flat at 25,981.85, reached a high of 26,098.25 and closed at 26,033.75. On the daily chart, Nifty formed a bullish candle with both upper and lower shadows. Its immediate resistance level is now placed at 26,100 while its immediate support is at 25,960.

BANK NIFTY: The index opened 61.15 points lower at 59,287.10 and closed at 59,288.70. Bank Nifty formed a Doji candle on the daily chart, indicating indecisiveness between buyers and sellers. Its immediate resistance level is now placed at 59,500 while immediate support is around 59,000.

Stocks in News

- Nectar Lifesciences: Stock surged over 17% after the Board announced an ₹81-crore share buyback, with the record date set for December 24, 2025. The buyback price of ₹27 represents a 51% premium compared to the previous closing price.

- Petronet LNG: Stock rose 4.5% following the company’s signing of a 15-year agreement with ONGC for ethane facilities.

- Interglobe Aviation: Stock fell 2.8% as the airline continues to face disruptions due to flight cancellations and delays caused by crew shortages under new FDTL rules. Read more: Will IndiGo Bounce Back, Or Is It Headed for a Crash Landing?

Global News

- Global equities edged higher on Thursday, supported by expectations of a U.S. rate cut next week, which is seen as crucial for sustaining the world’s largest economy amid slower employment growth.

- Oil prices remained steady, with focus on Ukraine’s attacks on Russian oil infrastructure. Stalled peace talks tempered expectations for a resolution that would restore Russian oil flows.

- Gold prices ticked lower as global equity markets rallied, reducing safe-haven demand. Investors turned their attention to next week’s U.S. Federal Reserve meeting and upcoming economic data that could shape the interest rate outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.