Liquide Post-Market Summary 3rd December 2025

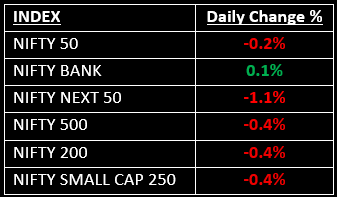

The Indian benchmark indices closed with minor losses, extending the losing streak for the fourth consecutive session on December 3. Among the broader indices, the BSE Midcap index declined by 1% and the BSE Smallcap index slipped 0.4%.

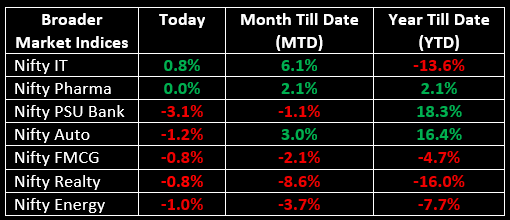

The Indian benchmark indices closed with minor losses, extending the losing streak for the fourth consecutive session on December 3. This was due to a falling rupee and broad-based selling across sectors, except for IT and Private Banks.

Despite positive global cues, the market opened on a flat note, but as the day progressed, selling pressure took charge, dragging Nifty below the 25,900 mark. However, buying in the final hour helped recover most of the losses, ending near the day's low.

Among the broader indices, the BSE Midcap index declined by 1% and the BSE Smallcap index slipped 0.4%. Sector-wise, IT, Media and Private Banks gained between 0.25% and 0.8%, while PSU Banks fell by 3%, and Oil & Gas, Metals and Consumer Durables declined by 0.5% to 1.6%.

NIFTY: The index opened 27 points lower at 26,004.90, reached a high of 26,066.45 and closed at 25,986. On the daily chart, Nifty formed a bearish candle with both upper and lower shadows, resembling a Doji-like candlestick pattern. Its immediate resistance level is now placed at 26,060 while its immediate support is at 25,880.

BANK NIFTY: The index opened 115 points lower at 59,158.70 and closed at 59,348.25. Bank Nifty formed a bullish candle with a lower shadow, indicating buying interest at lower levels. Its immediate resistance level is now placed at 59,500 while immediate support is around 59,000.

Stocks in News

- KPI Green Energy: Stock rose nearly 4% after the company secured a Rs 489 crore order from Gujarat State Electricity Corporation.

- RPP Infra Projects: Stock gained 2.6% after receiving a Letter of Award worth Rs 25.99 crore for a road-widening project in Tamil Nadu.

- Angel One: Stock fell over 5% after the company reported a 17% YoY decline in gross client acquisition for November, with orders dropping 10.4% YoY.

Global News

- Asian shares were mixed on Wednesday, while European shares edged higher, led by tech and industrial stocks. Improving global investor sentiment and positive corporate updates helped offset declines in heavyweight financial stocks.

- Oil prices rose by more than 1% following Russia's announcement that talks with U.S. officials in Moscow failed to reach a compromise on a potential Ukraine peace deal, which could have eased sanctions on Russia’s oil sector.

- Gold prices held steady, while silver retreated from a record high, as traders awaited key U.S. economic indicators to gauge the Federal Reserve's policy direction.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.