Liquide Post-Market Summary 30th October 2025

Indian equities ended lower on Thursday as cautious sentiment gripped investors following hawkish remarks from U.S. Federal Reserve Chair Jerome Powell. Top Gainer: COALINDIA |Top Loser: DRREDDY

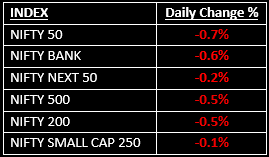

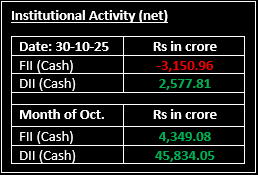

Indian equities ended lower on Thursday as cautious sentiment gripped investors following hawkish remarks from U.S. Federal Reserve Chair Jerome Powell. The Nifty 50 slipped below the 25,900 mark amid broad-based selling, as Powell’s comments reignited concerns that U.S. interest rates may stay elevated for longer — prompting profit booking across key sectors.

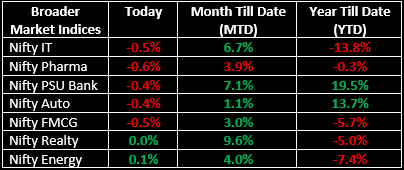

In the broader markets, the BSE Midcap index closed flat while the BSE Smallcap index edged marginally lower. Sectorally, barring Realty and Energy, all indices ended in the red. Meanwhile, in the primary market, Studds Accessories Ltd opened its IPO for subscription today. For an in-depth review of the company’s business, strengths, risks and valuation, read our full analysis here: Helmet Maker’s IPO Ride: Should You Strap In or Sit This One Out?

NIFTY: The index opened 69 points lower at 25,984 and made a high of 26,032 before closing at 25,877. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 26,000 while its immediate support is at 25,800.

BANK NIFTY: The index opened 233 points lower at 58,152 and closed at 58,031. Bank Nifty has formed a bearish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed around 58,200 while immediate support is around 57,900.

Stocks in Spotlight

▪ Sagility: Stock surged over 7% after Q2 net profit jumped 114% YoY to ₹250.8 crore, with revenue up 25% to ₹1,658.5 crore.

▪ PB Fintech: Stock rose 7% as Q2 net profit soared 165% YoY to ₹134.9 crore, while revenue rose 38% to ₹1,613.6 crore.

▪ Aditya Birla Capital: Stock jumped over 5% after reporting a 22% YoY rise in AUM to ₹1.39 lakh crore and a 29% YoY expansion in its loan book to ₹1.78 lakh crore in Q2 FY26.

Global News

▪ Asian and European markets nudged lower after the U.S. Federal Reserve cut rates as expected but signaled caution on further easing in December. Investors also weighed mixed corporate earnings and awaited the ECB’s policy decision.

▪ Oil prices softened as investors assessed a potential trade truce between the U.S. and China, following President Trump’s move to lower tariffs on Chinese goods after his meeting with President Xi Jinping in South Korea.

▪ Gold prices surged nearly 2%, supported by a weaker dollar after the Fed’s rate cut, as investors remained uncertain about the final outcome of the U.S.–China trade discussions.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.