Liquide Post-Market Summary 27th November 2025

Indian equity indices reached fresh record highs on November 27, 2025, surpassing the previous peak touched on September 27, 2024. Top Gainer: BAJFINANCE |Top Loser: ADANIENT

Indian equity indices reached fresh record highs on November 27, 2025, surpassing the previous peak touched on September 27, 2024. The market traded in positive territory, driven by rising expectations of rate cuts from both the Federal Reserve and Reserve Bank of India in their upcoming December policy meetings, as well as optimism surrounding a potential Russia-Ukraine peace deal.

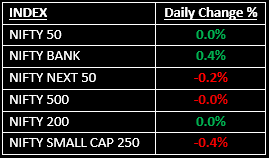

Indices began the session on a strong note, with the Sensex and Nifty reaching new record highs of 86,055.86 and 26,310.45, respectively. However, profit-booking in the second half of the session trimmed most of the gains, leaving the indices closing with little change.

On the sectoral front, except Media, Financial Services, IT, Private Banks and FMCG, all other sectors ended in the red. The Nifty Bank index surged to a fresh record high of 59,866.60, closing 0.35% higher. The Nifty Midcap 100 also touched a new record high, settling with minor gains, while the Nifty Smallcap index lost 0.5%.

NIFTY: The index opened 56 points higher at 26,261 and made a high of 26,310 before closing at 26,215. Nifty has formed a bearish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 26,300 while its immediate support is at 26,150.

BANK NIFTY: The index opened 77 points higher at 59,605 and closed at 59,737. Bank Nifty has formed a bullish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed at 59,850 while immediate support is around 59,650.

Stocks in Spotlight

▪ Patel Engineering: Stock surged 14% after the company secured two orders worth ₹798.19 crore from Saidax Engineers & Infrastructure.

▪ Ashok Leyland: Stock jumped over 7% following the approval of a merger between its subsidiary Hinduja Leyland Finance Ltd and real estate firm NDL Ventures.

▪ GMDC: Stock extended yesterday’s rally, rising another 5%, after the Union Cabinet approved a ₹7,280 crore incentive scheme to boost India’s domestic production of critical minerals and reduce reliance on China.

Global News

▪ European shares were subdued as investors paused after three consecutive days of gains, buoyed by expectations of a U.S. interest rate cut next month.

▪ Oil prices edged lower, as market participants anticipated a potential Ukraine-Russia ceasefire, which could lead to the easing of Western sanctions on Russian oil supplies.

▪ Gold prices remained steady, holding near a two-week high as investors weighed the likelihood of a U.S. interest rate cut in December.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.