Liquide Post-Market Summary 24th October 2025

Indian equity markets retreated on October 24, 2025, breaking a six-day rally as investors booked profits and tracked global volatility. Top Gainer: HINDALCO |Top Loser: CIPLA

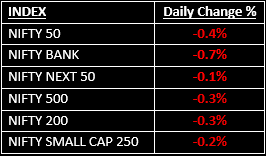

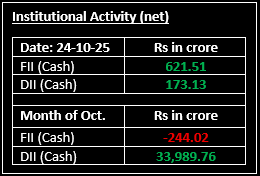

Indian equity markets retreated on October 24, 2025, breaking a six-day rally as investors booked profits and tracked global volatility. The BSE Sensex declined 344 points to close at 84,211.88, while the Nifty slipped 96 points, settling at 25,795.15 and falling below the key 25,800 mark. Broader indices performed slightly better but still weakened, with the Nifty Midcap 100 and Smallcap 100 down 0.24% and 0.21%, respectively.

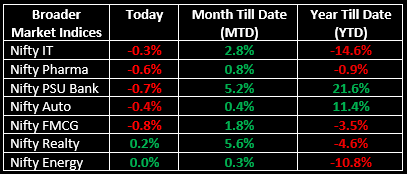

Banking stocks lost strength, and the Nifty Bank index closed at 57,699.60, down 0.65%. Metals bucked the trend, gaining nearly 1% on improved global risk appetite, while FMCG, IT, Pharma, PSU Bank, Private Bank, and Consumer Durables indices dropped 0.5%–1% amid profit-booking and cautious sentiment.

NIFTY: The index opened 44 points higher at 25,935 and made a high of 25,944 before closing at 25,795. Nifty has formed a bearish candle with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 25,900 while its immediate support is at 25,700.

BANK NIFTY: The index opened 94 points higher at 58,172 and closed at 57,699. Bank Nifty has formed a long bearish candle with a minor lower shadow on the daily chart. Its immediate resistance level is now placed around 57,900 while immediate support is around 57,500.

Stocks in Spotlight

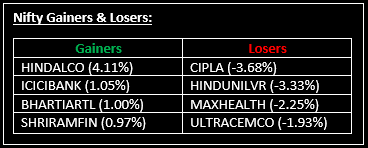

▪ Hindalco: Stock led gainers (up on improved global cues), joined by Bharti Airtel, ONGC, Shriram Finance, and ICICI Bank.

▪ Cipla and HUL: Stock fell sharply after reporting subdued earnings; Adani Ports and Max Healthcare also declined.

▪ UltraTech Cement and Dr Reddy’s featured among notable losers after mixed quarterly results.

Global News

▪ Global markets were volatile, with Asia rallying on optimism over a planned Trump–Xi Jinping meeting, raising hopes for US-China trade détente and lifting regional indices. European stocks were steadier, supported by resilient Eurozone activity, but investors remained cautious ahead of key US inflation data. US market sentiment was weighed by concerns over regional banks and credit risk.

▪ Crude oil prices ended lower at $63.31 a barrel, registering over 3% weekly decline due to new US sanctions on Russia and a forecasted global surplus, alongside muted demand from China.

▪ Gold reversed its rally, falling below $4,100 an ounce on profit booking and a stronger US dollar, ending a nine-week winning streak. The reversal reflected shifting risk sentiment as traders watched for US inflation signals and balanced geopolitical uncertainties.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.