Liquide Post-Market Summary 24th November 2025

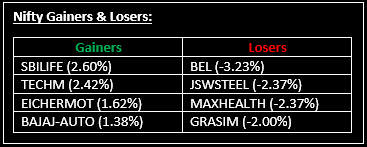

On November 24, a volatile trading session saw the benchmark indices end lower, dragged down by broad-based selling ahead of the monthly expiry. Top Gainer: SBILIFE |Top Loser: BEL

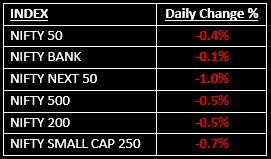

On November 24, a volatile trading session saw the benchmark indices end lower, dragged down by broad-based selling ahead of the monthly expiry. After failing to sustain early gains, heavy last-hour profit-booking pulled the Nifty 50 below the 26,000 mark, closing 108.65 points lower, while the Sensex slipped 331 points.

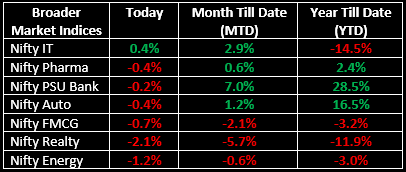

The broader markets underperformed the frontline indices, with the BSE Midcap index down 0.3% and the Smallcap index falling 0.8%. Among sectors, IT was the only gainer, while media, metal, realty, pharma, oil & gas and FMCG declined between 0.4% and 2%.

NIFTY: The index opened 54 points higher at 26,122 and made a high of 26,142 before closing at 25,959. Nifty has formed a long bearish candle on the daily chart. Its immediate resistance level is now placed at 26,000 while its immediate support is at 25,900.

BANK NIFTY: The index opened 129 points higher at 58,996 and closed at 58,835. Bank Nifty has formed a bearish candle with a long upper shadow and a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 58,900 while immediate support is around 58,750.

Stocks in Spotlight

▪ Bajaj Electricals: Stock surged up to 9% intraday following reports of initiating the sale process for its loss-making cookware unit, Nirlep.

▪ Rail Vikas Nigam: Stock gained 3.5% after winning a ₹180.8-crore contract from North Eastern Railway.

▪ H.G. Infra Engineering: Stock rose nearly 2% after its JV with Kalpataru Projects secured a ₹1,415-crore Thane Metro viaduct project.

Global News

▪ European markets edged higher, supported by heavyweight banks and rate-cut expectations in the U.S. and optimism around Ukraine peace talks.

▪ Crude oil prices continued to slide on Monday, extending last week’s nearly 3% decline, as markets balanced the likelihood of a potential U.S. rate cut with optimism around progress in the Ukraine peace talks, which could pave the way for easing sanctions on major producer Russia.

▪ Gold prices traded largely steady, supported by rising expectations of a Federal Reserve rate cut next month, which helped offset the impact of a stronger U.S. dollar.

▪ The Indian Rupee recorded its strongest single-day rebound in a month, recovering from near record lows. Read more: The Rupee Story: Reality Vs Panic

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.