Liquide Post-Market Summary 23rd October 2025

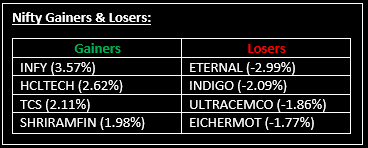

On October 23, Indian markets opened on a strong note but pared most of the intraday gains, closing marginally higher amid profit-booking in the final hour. Top Gainer: INFY |Top Loser: ETERNAL

On October 23, Indian markets opened on a strong note but pared most of the intraday gains, closing marginally higher amid profit-booking in the final hour. However, the winning streak extended for the sixth consecutive session, fuelled by optimism surrounding the US-India trade deal.

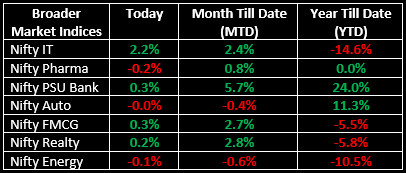

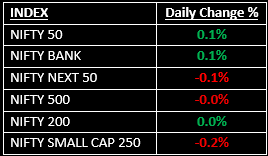

Among broader indices, the BSE Midcap index slipped 0.2% while the Smallcap index fell 0.4%. On the sectoral front, the IT index rose by 2.2%, Private Banks gained 0.5% and PSU Banks were up 0.3%. Meanwhile, the Oil & Gas index declined 0.6%. Bank Nifty hit a fresh record high of 58,577.50 intraday before closing with minor gains.

NIFTY: The index opened 189 points higher at 26,057 and made a high of 26,104 before closing at 25,891. Nifty has formed a long bearish candle with a minor upper shadow on the daily chart. Its immediate resistance level is now placed at 25,950 while its immediate support is at 25,800.

BANK NIFTY: The index opened 307 points higher at 58,314 and closed at 58,078. Bank Nifty has formed a bearish candle with a long upper and minor lower shadow on the daily chart. Its immediate resistance level is now placed around 58,250 while immediate support is around 57,850.

Stocks in Spotlight

▪ EPack Prefab Technologies: Stock surged 14% after the company reported a 104% jump in Q2 net profit to Rs 29.5 crore, with revenue climbing 62% YoY to Rs 433.9 crore.

▪ Bharat Forge: Stock jumped 4.6% on news of a potential order from the Indian Army. However, the company later clarified that no contract had been signed yet.

▪ Jain Resource Recycling: Stock rose nearly 4% after reporting a 78% increase in Q2 net profit to Rs 99.2 crore, with revenue rising 52% YoY to Rs 2,113.7 crore.

Global News

▪ European markets rose on Thursday, led by energy stocks following the U.S. imposition of new sanctions on Russia. Investors also digested a fresh batch of corporate earnings reports from across Europe.

▪ Oil prices surged by around 5%, reaching a two-week high, following U.S. sanctions on major Russian suppliers amid the ongoing Ukraine conflict.

▪ Gold prices gained over 1% after two consecutive sessions of losses, with renewed geopolitical tensions fuelling safe-haven demand. Investors are also bracing for key U.S. inflation data set to be released on Friday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.