Liquide Post-Market Summary 23rd December 2025

On December 23, the Indian markets struggled to build on their early gains, trading within a narrow range throughout the session. After a positive opening, the market remained confined to a tight range for most of the day.

On December 23, the Indian markets struggled to build on their early gains, trading within a narrow range throughout the session. After a positive opening, the market remained confined to a tight range for most of the day. A slight dip was observed towards the end, with Nifty closing flat-to-positive.

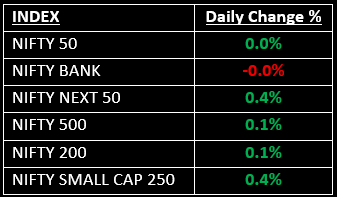

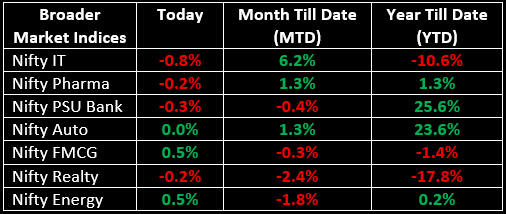

Among the broader indices, the BSE Midcap index remained largely unchanged, while the BSE Smallcap index gained 0.4%. Sector-wise, Media, Metal, FMCG and Energy sectors saw gains between 0.5% and 0.8%, while the IT sector declined by 0.8%.

NIFTY: The index opened 32.80 points higher at 26,205.20, reached a high of 26,233.55 and closed at 26,177.15. Nifty formed a small bearish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 26,230 while immediate support is at 26,100.

BANK NIFTY: The index opened 30.35 points higher at 59,334.35 and closed at 59,299.55. Bank Nifty also formed a small bearish candle with slightly long upper and lower shadows. Its immediate resistance level is now placed at 59,400 while immediate support is around 59,150.

Stocks in News

- Antony Waste Handling Cell: Stock surged 8% after the company secured a ₹329.45 crore contract from the Thane Municipal Corporation.

- Puravankara: Stock jumped nearly 8% following the announcement of the acquisition of a 53.5-acre land parcel in Bengaluru, strengthening its position in one of the city’s emerging residential growth corridors.

- Shakti Pumps: Stock rose 2.5% after the company received a ₹357 crore solar pump order from MSEDCL.

Other News

- Asian markets largely remained in positive territory, buoyed by expectations of U.S. interest rate cuts and stable sector-specific trends, though trading volume was lighter due to the holiday season.

- European shares briefly reached a record high on Tuesday, driven by gains in the healthcare sector following Novo Nordisk’s U.S. approval of its weight-loss pill. However, declines in bank stocks limited the overall advance.

- Oil prices showed little movement on Tuesday, as the potential sale of Venezuelan crude seized by the U.S. was offset by concerns over supply disruptions, particularly after Ukrainian attacks on Russian vessels and piers.

- Gold reached a record high on Tuesday, nearing the $4,500 per ounce mark, as a weaker dollar and ongoing geopolitical uncertainty increased demand for the safe-haven asset. Meanwhile, Silver continued its rally, reaching an all-time high.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.