Liquide Post-Market Summary 21st November 2025

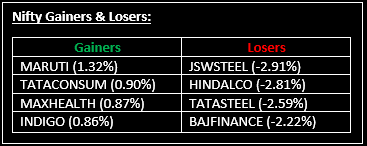

The Indian markets ended lower on November 21, snapping a two-day winning streak in a volatile session. The Nifty fell below the 26,100 mark amid broad-based selling across sectors. Top Gainer: MARUTI |Top Loser: JSWSTEEL

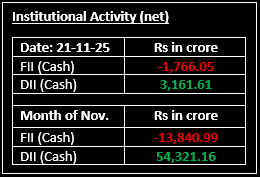

The Indian markets ended lower on November 21, snapping a two-day winning streak in a volatile session. The Nifty fell below the 26,100 mark amid broad-based selling across sectors. Weak global cues led to a lower opening for Indian indices, which was followed by extended selling. Although there was some mid-session buying, the market closed near its day's lows.

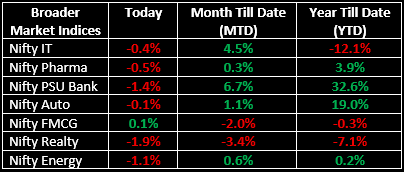

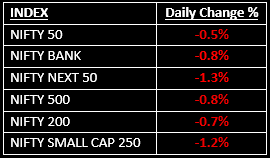

Broader indices underperformed the main benchmarks, with the BSE Midcap and Smallcap indices both falling 1.3%. With the exception of FMCG, all sectoral indices ended in the red.

In the primary market, pharma excipient company Sudeep Pharma Ltd launched its IPO today. For a detailed review of its business model, strengths, risks and valuation, read our analysis here: Sudeep Pharma IPO: A Growing Player in Pharma, But Is It a Safe Bet?

NIFTY: The index opened 83 points lower at 26,109 and made a high of 26,179 before closing at 26,068. Nifty has formed a bearish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 26,100 while its immediate support is at 26,000.

BANK NIFTY: The index opened 231 points lower at 59,116 and closed at 58,867. Bank Nifty has formed a bearish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed around all time high of 59,000 while immediate support is around 58,700.

Stocks in Spotlight

▪ Karnataka Bank: Stock surged almost 8% after approximately 62.94 lakh shares changed hands in ten block deals at an average price of ₹186.22 per share.

▪ Billionbrains Garage Ventures: Stock jumped 5% intraday following a reported net profit of ₹471.3 crore, up 12% from ₹420.1 crore a year ago. On a sequential basis, profit increased by 25% from ₹378 crore in Q2.

▪ Hindalco Industries: Stock fell nearly 3% after reports surfaced of another fire at its Novelis unit in Oswego, New York.

Global News

▪ European and Asian markets fell on Friday, continuing a sell-off after a sharp decline in Wall Street overnight. Tech stock valuations remained a concern and mixed U.S. jobs data added to market uncertainty, reducing hopes for further rate cuts by the Federal Reserve this year.

▪ Oil prices dropped more than 2% on Friday, extending declines for the third consecutive session. The U.S. pushed for a peace deal between Russia and Ukraine, which could increase global oil supply, while ongoing uncertainty around interest rates dampened investor risk appetite.

▪ Gold prices fell over 1% on Friday and were set to close the week lower. A strong U.S. jobs report diminished expectations for a Federal Reserve rate cut in the near term, weighing on the appeal of the non-yielding metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.