Liquide Post-Market Summary 20th October 2025

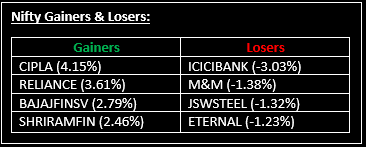

The Indian equity market wrapped up the final session of Samvat 2081 on a positive note, marking its fourth consecutive day of gains. Top Gainer: CIPLA |Top Loser: ICICIBANK

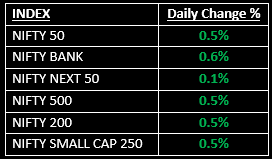

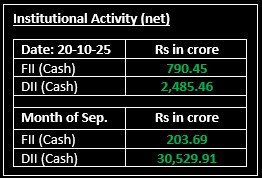

The Indian equity market wrapped up the final session of Samvat 2081 on a positive note, marking its fourth consecutive day of gains. Nifty started the session strong, crossing the 25,800 mark and extended its upward momentum, surpassing 25,900 intraday. The rally was fuelled by strong buying interest in heavyweight stocks like Reliance Industries and leading banking names, driven by impressive Q2 earnings reports.

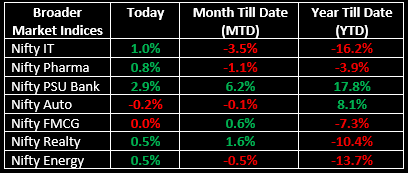

Among the broader indices, the BSE Midcap index gained 0.7% while the Smallcap index rose 0.6%. Nifty Bank hit a fresh record high, crossing the 58,000 mark for the first time and peaking at 58,261.55 intraday. On the sectoral front, PSU Banks, IT and Oil & Gas sectors saw gains between 1-3%, while Auto, Financials and Metals ended the session marginally lower.

The markets will remain closed for regular trading on October 21 and 22. However, NSE will conduct a special 'Muhurat Trading' session on October 21 between 1:45 pm and 2:45 pm to mark the Diwali festival. Read on to find out what makes this year’s session unique: Diwali Muhurat Trading 2025.

NIFTY: The index opened 115 points higher at 25,824 and made a high of 25,926 before closing at 25,843. Nifty has formed a small bullish candle with a long upper shadow and minor lower shadow on the daily chart. Its immediate resistance level is now placed at 25,900 while its immediate support is at 25,800.

BANK NIFTY: The index opened 159 points higher at 57,872 and closed at 58,033. Bank Nifty has formed a bullish candle with an upper shadow on the daily chart. Its immediate resistance level is now placed around 58,250 while immediate support is around 57,900.

Stocks in Spotlight

▪ South Indian Bank: Stock surged over 15% after the lender reported its highest-ever quarterly net profit of Rs 351 crore, marking an 8% YoY growth.

▪ RBL Bank: Stock jumped 9% following the announcement that Emirates NBD Bank would acquire a 60% stake in the lender through a primary infusion of around $3 billion.

▪ Can Fin Homes: Stock rose nearly 5% after the company posted a 19% YoY jump in Q2 net profit, reaching Rs 251.43 crore, while revenue climbed 9% to Rs 1,049.45 crore.

Global News

▪ Asian and European Markets advanced on Monday, following a positive close on Wall Street, as concerns over bank lending and the ongoing U.S.-China trade war eased.

▪ Crude oil prices slipped, pressured by concerns over a global supply glut amid continued U.S.-China trade tensions, which have sparked fears of an economic slowdown and reduced energy demand.

▪ Gold prices inched higher after a record rally, supported by expectations of further U.S. interest rate cuts and ongoing demand for safe-haven assets, particularly in light of the government shutdown in Washington.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.