Liquide Post-Market Summary 2nd December 2025

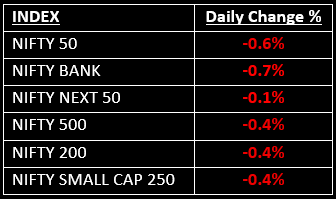

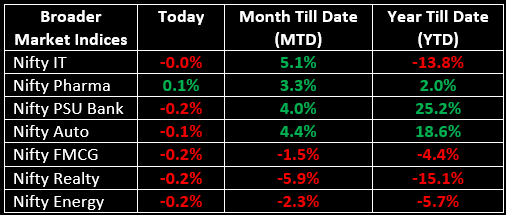

The Indian markets closed in the red for the third consecutive session on December 2, with Nifty settling around 26,000. On the sectoral front, except for Pharma, all other sectors closed in the red.

The Indian markets closed in the red for the third consecutive session on December 2, with Nifty settling around 26,000. The decline was primarily driven by further depreciation in the Indian rupee and broad-based selling across sectors. The rupee touched a fresh record low of 89.95 per dollar intraday before closing at 89.87 per dollar.

Among broader indices, the BSE Midcap index declined by 0.14%, while the BSE Smallcap index shed 0.5%. On the sectoral front, except for Pharma, all other sectors closed in the red. Investor attention now turns to the Reserve Bank of India’s three-day monetary policy meeting, which begins tomorrow, with the outcome expected on December 5.

NIFTY: The index opened 88 points lower at 26,088, reached a high of 26,154 and closed at 26,032. On the daily chart, Nifty has formed a small bearish candle with shadows on both sides. Its immediate resistance level is now placed at 26,100 while its immediate support is at 25,980.

BANK NIFTY: The index opened 327 points lower at 59,354 and closed at 59,274. Bank Nifty formed a small bearish candle with a long upper shadow, reflecting selling pressure at elevated levels. Its immediate resistance level is now placed at 59,500 while immediate support is around 59,100.

Stocks in News

- Emmvee Photovoltaic Power: Stock surged more than 9% after Q2 net profit skyrocketed by 584% to ₹240 crore, with revenue rising 182% YoY to ₹1,130 crore.

- Websol Energy System: Stock soared 6.5% after the company signed an agreement with Linton to explore PV Ingot and Wafer manufacturing in India.

- Apollo Micro Systems: Stock jumped 4.5% after receiving a 15-year license from the Department for Promotion of Industry & Internal Trade (DPIIT) to manufacture defence aircraft equipment.

Global News

- European shares edged slightly higher, with gains in banks outweighing declines in healthcare. Bayer's stock surged after the U.S. administration supported the German pharmaceutical company's appeal against lawsuits related to its weedkiller.

- Oil prices remained stable, with traders weighing risks from Ukrainian drone strikes on Russian energy sites and escalating U.S.-Venezuela tensions.

- Gold prices slipped, pressured by rising U.S. Treasury yields and profit-booking after hitting a six-week high. Silver pulled back from its record high set in the previous session.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.