Liquide Post-Market Summary 1st December 2025

The Indian markets kicked off the week on a positive note, reaching a fresh all-time high in early trade, buoyed by favourable global cues and a stronger-than-expected GDP growth of 8.2% for Q2FY26, the highest in six quarters.

The Indian markets kicked off the week on a positive note, reaching a fresh all-time high in early trade, buoyed by favourable global cues and a stronger-than-expected GDP growth of 8.2% for Q2FY26, the highest in six quarters.

However, the sentiment turned negative following a 9-month low in manufacturing growth, with the PMI dipping to 56.6 in November, and a weakening rupee, which erased all the intraday gains. The market traded in a narrow range during the second half of the day, as investors awaited key interest rate decisions from both the US and Indian central banks later this week.

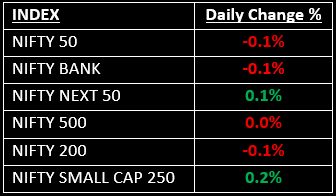

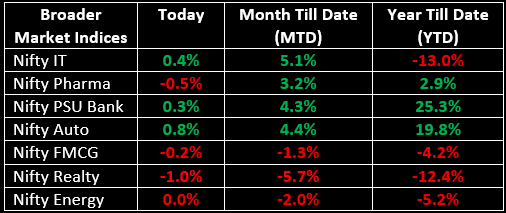

Among the broader indices, the BSE Midcap index fell 0.2%, while the Smallcap index saw marginal gains. Sector-wise, Auto, IT, PSU Banks and Metals rose between 0.3% and 0.8%, while the Realty index declined by 1% and the Consumer Durables and Pharma indices each dropped by 0.5%.

NIFTY: The index opened 122 points higher at 26,325 (which was also the day’s high) and closed at 26,175. Nifty has formed a long bearish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed at 26,250 while its immediate support is at 26,100.

BANK NIFTY: The index opened 350 points higher at 60,102 and closed at 59,681. Bank Nifty has also formed a bearish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed at 59,900 while immediate support is around 59,500.

Stocks in News

- Wockhardt: Stock surged over 19% after the USFDA formally accepted the New Drug Application (NDA) for the company's antibiotic, Zaynich.

- Lenskart Solutions: Stock jumped nearly 5% following a 20% YoY increase in Q2 net profit, reaching ₹102.2 crore, while revenue climbed 21% YoY to ₹2,096 crore.

- Tejas Networks: Stock rose nearly 4% after the company secured an ₹84.95 crore order from the Ministry of Communications under the PLI scheme.

Global News

- Asian shares started the week mixed, with Tokyo’s benchmark dropping nearly 2% on Monday after data showed weak factory activity.

- European shares slipped, with defence stocks and planemaker Airbus weighing down industrials. A risk-averse sentiment spread across markets following November’s gains.

- Oil prices rose by 2% as the Caspian Pipeline Consortium halted exports due to a major drone attack and U.S.-Venezuela tensions raised concerns about supply. Meanwhile, OPEC+ agreed to keep oil output levels unchanged for Q1 2026.

- Gold prices climbed to their highest level in six weeks, driven by investor expectations of a possible U.S. interest rate cut and shifts in Federal Reserve leadership. Silver also surged to a record high.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.