Liquide Post-Market Summary 19th November 2025

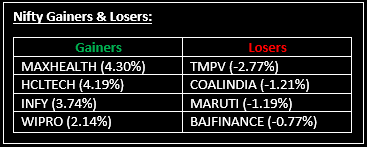

Indian equity markets rebounded strongly on November 19, erasing the previous session’s losses, with Nifty closing above the 26,000 mark driven by IT and PSU Banks. Top Gainer: MAXHEALTH |Top Loser: TMPV

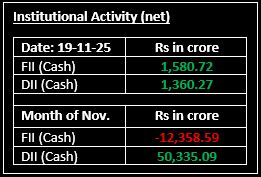

Indian equity markets rebounded strongly on November 19, erasing the previous session’s losses, with Nifty closing above the 26,000 mark driven by IT and PSU Banks. After a cautious start following weak global cues, sentiment improved through the day, helping the benchmark index finish near the day’s high despite brief mid-session profit-booking pressure.

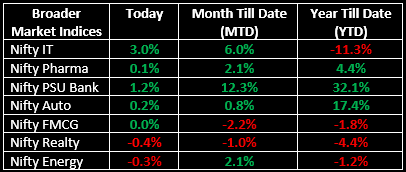

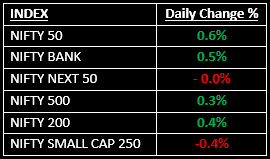

Broader markets were mixed — the BSE Midcap index gained 0.3% while the Smallcap index slipped 0.4%. Nifty Bank continued its record-setting run for the third straight session. Across sectors, IT surged 3%, PSU Banks gained 1.2% while Media and Realty slipped around 0.3%.

In the primary market, Mysuru-based SaaS company Excelsoft Technologies Ltd launched its IPO today. For a detailed review of its business model, strengths, risks and valuation, read our analysis here: EdTech Meets SaaS: Is Excelsoft IPO Ready for the Big League?

NIFTY: The index opened flat at 25,918 and made a high of 26,074 before closing at 26,052. Nifty has formed a bullish candle with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 26,100 while its immediate support is at 26,000.

BANK NIFTY: The index opened flat at 58,908 and closed at 59,216. Bank Nifty has formed a bullish candle with a lower shadow on the daily chart. Its immediate resistance level is now placed around all time high of 59,265 while immediate support is around 59,150.

Stocks in Spotlight

▪ Avanti Feeds: Stock jumped nearly 10% after reports emerged that China has asked Japan to stop seafood exports.

▪ Infosys: Stock rose almost 4% as the company announced a buyback of 10 crore shares at ₹1,800 each, commencing November 20.

▪ KEC International: Stock plunged over 9% after Power Grid barred the company from participating in tenders for nine months.

Global News

▪ Markets across Asia and Europe remained cautious following another selloff triggered by concerns over stretched AI valuations, with traders awaiting key earnings from Nvidia and upcoming U.S. jobs data.

▪ Crude oil slipped slightly after U.S. inventory data signalled oversupply, though losses were limited by tighter fuel availability due to disruptions at Russian oil facilities.

▪ Gold edged higher supported by safe-haven demand ahead of the Federal Reserve meeting minutes and delayed U.S. labour data.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.