Liquide Post-Market Summary 19th December 2025

The Indian benchmark indices broke their four-day losing streak and ended on a strong note, with Nifty closing above 25,950. The broader indices outperformed the frontline benchmarks, with the BSE Midcap and Smallcap indices rising by ~1.3% each.

The Indian benchmark indices broke their four-day losing streak and ended on a strong note, with Nifty closing above 25,950. This rally was driven by broad-based buying across sectors and heightened optimism for further rate cuts by the Federal Reserve, following soft US inflation data.

The broader indices outperformed the frontline benchmarks, with the BSE Midcap and Smallcap indices rising by ~1.3% each. All sectoral indices ended in the green, with Auto, Oil & Gas, Realty and Healthcare sectors gaining over 1% each.

NIFTY: The index opened 96 points higher at 25,911.50, reached a high of 25,993.35 and closed at 25,966.40. Nifty formed a bullish candle with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 26,020 while immediate support is at 25,900.

BANK NIFTY: The index opened 135 points higher at 59,047.40 and closed at 59,069.20. Bank Nifty formed a Doji-like candlestick pattern, indicating indecision between the bulls and bears. Its immediate resistance level is now placed at 59,210 while immediate support is around 58,880.

Stocks in News

- ITI: Stock surged over 6% after the company announced plans to monetize its 91-acre land in Bengaluru for ₹3,473 crore, aimed at clearing its outstanding dues and loans.

- NBCC: Stock jumped 5% following the announcement of a ₹179 crore PMC contract for the expansion of the IIM Sambalpur campus.

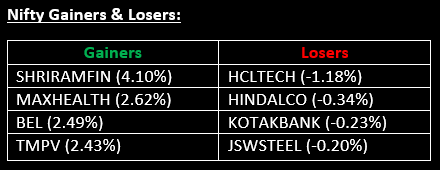

- Shriram Finance: Stock rose nearly 4% after news broke that Japan's MUFG will acquire a 20% stake in the NBFC for ₹39,600 crore ($4.4 billion) through a preferential allotment of equity shares.

Other News

- Major Asian stock markets closed higher on Friday, buoyed by positive sentiment from softer-than-expected US inflation data, which fueled expectations for future interest rate cuts.

- European shares were largely unchanged, with losses in tech and consumer stocks being offset by gains in the banking sector.

- Oil prices remained largely flat on Friday and were heading for a second consecutive weekly decline, as concerns over a potential supply glut and a possible Russia-Ukraine peace deal outweighed worries about disruptions from a blockade of Venezuelan oil tankers.

- Gold prices slipped slightly on Friday, pressured by a stronger dollar and year-end investor positioning. However, the yellow metal was set to finish the week higher, supported by softened US inflation data that increased expectations for interest rate cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.