Liquide Post-Market Summary 18th December 2025

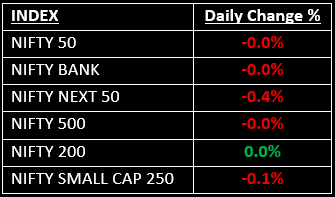

The Indian benchmark indices ended flat, marking their fourth consecutive day of losses after a range-bound trading session on December 18.

The Indian benchmark indices ended flat, marking their fourth consecutive day of losses after a range-bound trading session on December 18. The markets opened lower amid weak global cues but saw mid-session buying, which helped them recover the initial losses and trade in positive territory for most of the day. However, selling in the final hours wiped out the gains, leaving the indices near the flatline.

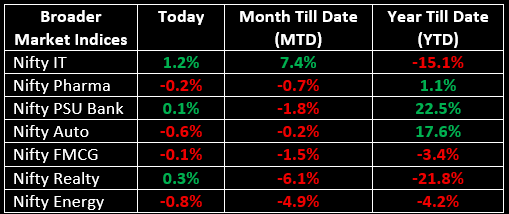

In the broader market, the BSE Midcap index ended marginally higher, while the BSE Smallcap index slipped by 0.3%. On the sectoral front, the Realty index rose by 0.3% and the IT index gained 1.2%, while Auto, Media and Energy sectors saw declines ranging from 0.6% to 1.3%.

NIFTY: The index opened 53.85 points lower at 25,764.70, reached a high of 25,902.35 and closed at 25,815.55. On the daily chart, Nifty has formed a bullish candle with a long upper and a minor lower shadow. Its immediate resistance level is now placed at 25,900 while immediate support is at 25,725.

BANK NIFTY: The index opened 214.05 points lower at 58,712.70 and closed at 58,912.85. Bank Nifty formed a bullish candle with a long upper shadow, resembling an inverted hammer pattern. Its immediate resistance level is now placed at 59,200 while immediate support is around 58,700.

Stocks in News

- Antony Waste Handling Cell: Stock surged 18% after the company secured two contracts worth ₹1,330 crore from the Brihanmumbai Municipal Corporation.

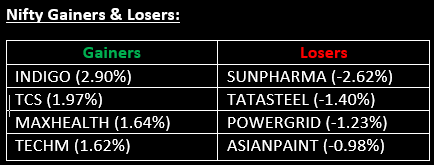

- Interglobe Aviation: Stock rose nearly 3% after CEO Pieter Elbers reassured employees, stating, "The worst is behind us." This follows a crisis earlier this month that caused significant cancellations and disruptions.

- Patel Engineering: Stock gained over 2% after the company signed an MoU with Arunachal Pradesh for a ₹1,700 crore hydropower project.

Other News

- Asian markets were mostly lower on Thursday, following Wall Street’s decline as technology stocks, particularly AI-related names, pressured sentiment.

- European shares were largely flat, with losses in major healthcare and financial stocks offsetting broader gains. Investors remained cautious ahead of the European Central Bank's policy announcement and U.S. inflation data.

- Oil prices edged slightly higher on Thursday as investors assessed the potential impact of further U.S. sanctions on Russia and supply risks stemming from a blockade of Venezuelan oil tankers.

- Gold prices held steady, buoyed by dovish signals from the Federal Reserve but capped by a strong dollar ahead of key U.S. inflation data. Meanwhile, silver hovered near record highs.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.