Liquide Post-Market Summary 14th October 2025

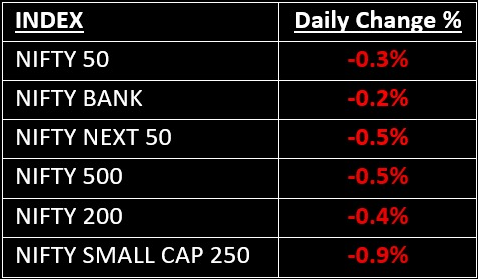

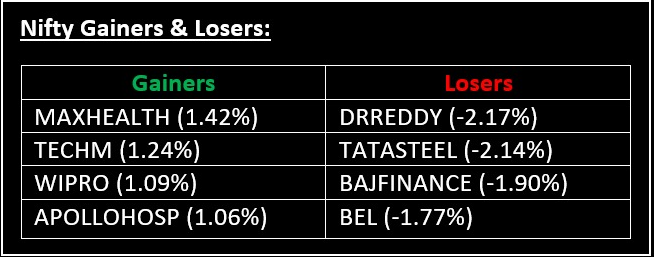

On October 14, the Indian benchmark indices continued their downward trend from the previous session, with the Nifty slipping below the 25,100 mark during intraday trading due to broad-based selling. Top Gainer: MAXHEALTH |Top Loser: DRREDDY

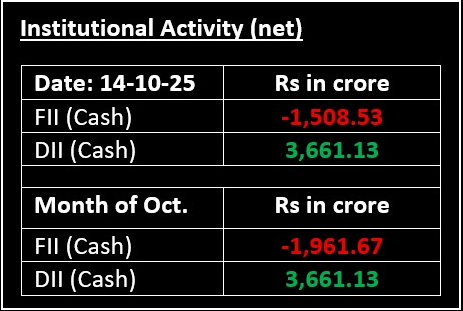

On October 14, the Indian benchmark indices continued their downward trend from the previous session, with the Nifty slipping below the 25,100 mark during intraday trading due to broad-based selling. Despite opening higher on the back of positive global cues, the market failed to sustain the early gains and quickly erased them within the first few hours. Profit-booking took over as the day progressed, leading to a lower close for the second consecutive day.

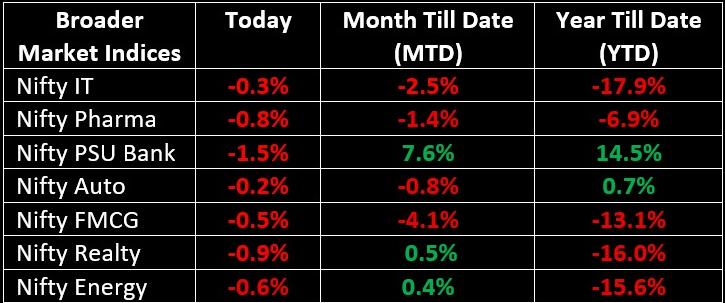

In the broader markets, the BSE Midcap index fell by 0.74%, while the Smallcap index shed 0.95%. Market breadth remained weak, with all sectors closing in the red. Realty, consumer durables, metal, media and PSU Bank indices saw losses of 1-1.5%.

NIFTY: The index opened 50 points higher at 25,277 and made a high of 25,310 before closing at 25,145. Nifty has formed a bearish candle with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 25,200 while its immediate support is at 25,050.

BANK NIFTY: The index opened 27 points lower at 56,598 and closed at 56,496. Bank Nifty has formed a small bearish candle with minor upper and long lower shadows on the daily chart. Its immediate resistance level is now placed around 56,550 while immediate support is around 56,350.

Stocks in Spotlight

▪ MTAR Technologies: Stock surged nearly 13% after news surfaced that Brookfield had invested $5 billion in Bloom Energy to advance fuel cell technology for AI data centres. MTAR Tech is a key strategic supplier to Bloom Energy.

▪ Anand Rathi Wealth: Stock jumped almost 8% after the company reported a 31% growth in Q2 profit, reaching Rs 99.89 crore, while revenue rose by 23% YoY to Rs 297.4 crore.

▪ Indian Renewable Energy Development Agency: Stock rose 3% following a nearly 42% increase in net profit, which climbed to Rs 549 crore, while revenue grew 26% YoY to Rs 2,057.3 crore.

Global News

▪ Asian stocks fell on Tuesday, fuelled by renewed concerns over U.S.-China trade tensions. European markets also declined as Michelin’s shares plummeted to a two-year low after the French tire maker downgraded its annual forecast.

▪ Gold prices surged to a record high above $4,100, supported by growing expectations of a U.S. Federal Reserve rate cut this month and increased safe-haven demand amid escalating U.S.-China trade tensions.

▪ Oil prices saw a slight increase, driven by early indications of a thaw in U.S.-China trade tensions, which improved market sentiment and alleviated concerns about global fuel demand.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.