Liquide Post-Market Summary 14th November 2025

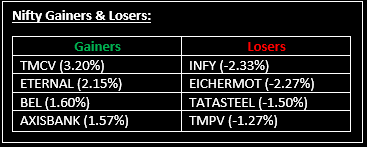

Equity benchmark indices managed to close in the green on November 14, extending gains for the fifth consecutive session, supported by strong fag-end buying. Top Gainer: TMCV |Top Loser: INFY

Equity benchmark indices managed to close in the green on November 14, extending gains for the fifth consecutive session, supported by strong fag-end buying. Markets opened weak amid negative global cues following a sharp overnight sell-off on Wall Street and traded under pressure for most of the day. However, a late surge in buying during the last 30 minutes lifted sentiment, driven by investor focus on the Bihar election outcome, which acted as the key market catalyst.

In the broader market, both the Nifty Midcap 100 and Nifty Smallcap 100 managed to end positive. Sector-wise, PSU Banks, FMCG and Pharma were the top gainers, rising between 0.6% and 1.2%, while Auto, IT and Metal fell between 0.5% to 1%.

NIFTY:The index opened 112 points lower at 25,767 and made a high of 25,940 before closing at 25,910. Nifty has formed a long bullish candle on the daily chart. Its immediate resistance level is now placed at 26,000 while its immediate support is at 25,850.

BANK NIFTY: The index opened 331 points lower at 58,050 and closed at 58,517. Bank Nifty has also formed a long bullish candle on the daily chart. Its immediate resistance level is now placed around 58,620 while immediate support is around 58,400.

Stocks in Spotlight

▪ KRBL: Stock spiked 13% after Q2 net profit jumped 68% to ₹172.1 crore, while revenue rose 19% YoY to ₹1,511 crore.

▪ Muthoot Finance: Stock soared almost 10% after Q2 net profit surged 87% to ₹2,345.2 crore, with revenue up 59% YoY to ₹3,991.7 crore.

▪ Paras Defence & Space Technologies: Stock jumped 6.5% after Q2 net profit increased 50% to ₹21 crore, while revenue climbed 22% YoY to ₹106 crore.

Global News

▪ Stocks across Asian and European markets fell on Friday as a hawkish stance from U.S. Federal Reserve officials dampened hopes of a December rate cut, while a heavy economic-data calendar and rising concerns over a potential AI-driven bubble weighed on sentiment.

▪ Oil prices gained around 1%, supported by supply disruption fears after a Ukrainian drone attack hit an oil depot at the Russian Black Sea export hub, Novorossiysk.

▪ Gold prices rose on Friday and were on track for a weekly gain, supported by a weaker U.S. dollar as investors awaited additional economic data to assess the probability of a December rate cut, despite the Fed’s hawkish commentary.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.