Liquide Post-Market Summary 12th December 2025

On December 12, Indian equity benchmarks continued their upward trajectory, buoyed by positive global cues and improved risk sentiment following the US Federal Reserve's interest rate cut.

On December 12, Indian equity benchmarks continued their upward trajectory, buoyed by positive global cues and improved risk sentiment following the US Federal Reserve's interest rate cut.

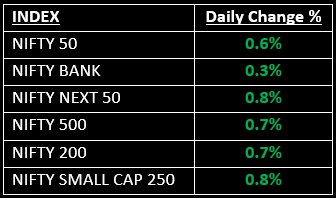

The broader indices outperformed the major benchmarks, with the BSE Midcap index rising more than 1% and the BSE Smallcap index climbing 0.65%. Of the 4,356 stocks traded on the BSE, 2,593 advanced, 1,593 declined, and 170 remained unchanged.

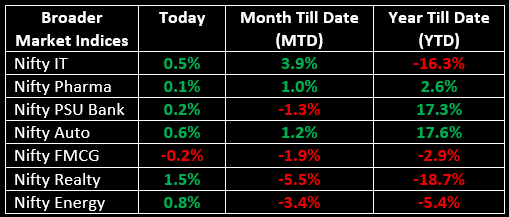

Sector-wise, all sectors finished in the green, except for FMCG and Media.

NIFTY: The index opened 72.65 points higher at 25,971.20, reached a high of 26,057.60 and closed at 26,046.95. Nifty formed a bullish candle on the daily chart. Its immediate resistance level is now placed at 26,080 while immediate support is at 25,990.

BANK NIFTY: The index opened 191.65 points higher at 59,401.50 and closed at 59,389.95. Bank Nifty formed a Doji candle on the daily chart, indicating indecisiveness among the bulls and bears. Its immediate resistance level is now placed at 59,550 while immediate support is around 59,130.

Stocks in News

- Hindustan Copper: Stock surged 7%, in line with other metal stocks, following China’s announcement of a 'proactive' fiscal policy aimed at increasing consumption and investment, boosting investor sentiment.

- JSW Energy: Stock jumped over 5% after the company secured a 25-year Power Purchase Agreement (PPA) with Karnataka's power distribution companies through its subsidiary, for 400 MW of electricity starting April 1, 2026.

- IDBI Bank: Stock rose nearly 5% after reports indicated that Toronto-based Fairfax Financial is leading the race to acquire a controlling stake in the Indian lender from the government and the Life Insurance Corporation of India.

Global News

- European and Asian markets rose on Friday, mirroring Wall Street’s gains as investors reacted positively to the Federal Reserve’s interest rate cut and maintained optimism for further reductions in 2026.

- Oil prices climbed on Friday, driven by concerns over supply disruptions in Venezuela. However, they were still poised for a weekly decline, with ongoing worries about a global supply glut and the potential impact of a Russia-Ukraine peace deal.

- Gold surged to a seven-week high, fuelled by safe-haven demand and expectations of further U.S. rate cuts following the Fed's recent dovish shift, while Silver reached a record high.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.