Liquide Market Summary 7th January 2026

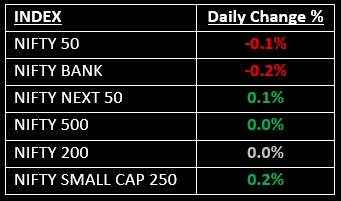

The Indian benchmark indices extended their decline for the third consecutive session on January 7, with the Nifty closing below 26,150.

Indian Stock Market Today: The Indian benchmark indices extended their decline for the third consecutive session on January 7, with the Nifty closing below 26,150, amid heightened volatility driven by concerns over escalating geopolitical risks, FII selling and weak Asian markets.

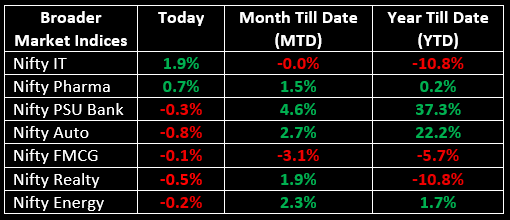

Broader indices outperformed, with the BSE Midcap index rising by 0.5%, while the Smallcap index gained 0.12%. Sector-wise, Consumer Durables, IT and Pharma sectors saw gains of 0.7% to 1.8%, while Auto, Oil & Gas and Realty sectors lost between 0.5% to 0.8%.

Also Read: Is India Safe from the US-Venezuela Tensions?

NIFTY: The index opened 35.60 points lower at 26,143.10, reached a high of 26,187.15 and closed at 26,140.75. Nifty formed a Doji candle on the daily timeframe, with above-average volumes for the second straight session. Its immediate resistance level is now placed at 26,200 while immediate support is at 26,060.

BANK NIFTY: The index opened 78.70 points lower at 60,039.70, reached a high of 60,065.40 and closed at 59,990.85. Bank Nifty formed a small bearish candle with a long lower shadow, indicating minor weakness, along with buying interest at lower levels. Its immediate resistance level is now placed at 60,100 while immediate support is around 59,800.

Stocks in News

- Senco Gold: Stock surged over 11% following a robust 51% YoY jump in Q3 revenue, fuelled by a 49% growth in its retail business and a 39% increase in same-store sales growth (SSSG).

- Titan Company: Stock rose nearly 4% as the company reported a 38% growth in its domestic business and a 79% increase in international operations compared to the same quarter last year.

- CMS Info Systems: Stock gained 2.5% after the company secured a ₹1,000 crore contract from SBI, marking the first direct large PSU bank cash outsourcing deal for ₹5,000 bank-owned ATMs across India.

Other News

- European stocks were subdued on Wednesday following a streak of record closes, as investors took a breather to digest the latest U.S.-Venezuela developments and awaited fresh economic data.

- Oil prices fell on Wednesday after President Trump announced that the United States had reached a deal to import up to $2 billion worth of Venezuelan crude, a move expected to increase supplies to the world's largest oil consumer.

- Gold prices declined on Wednesday as a stronger dollar and investors reassessing the recent developments in the U.S.-Venezuela situation weighed on the metal..

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.