Liquide Market Summary 6th January 2026

The Indian equity markets extended their decline for the second consecutive session on January 6, amid selling pressure in oil & gas stocks.

Indian Stock Market Today: The Indian equity markets extended their decline for the second consecutive session on January 6, amid selling pressure in oil & gas stocks. The session began on a negative note, with Nifty falling below 26,200. Despite a brief recovery in the first hour, renewed tensions between the US and Venezuela, along with concerns over US tariffs on India, pulled Nifty down, leading to a close near the day’s low.

Also Read: Is India Safe from the US-Venezuela Tensions?

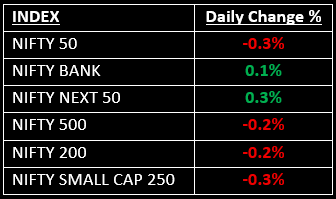

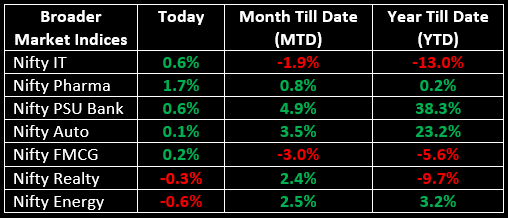

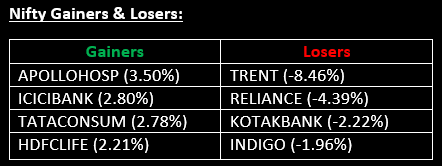

Among the broader indices, the BSE Midcap index slipped 0.2%, while the BSE Smallcap index fell 0.4%. On the sectoral front, IT, Pharma and PSU Banks rose by 0.5-1.7%, while Infra, Media and Oil & Gas sectors saw a decline of over 1%.

NIFTY: The index opened 60.60 points lower at 26,189.70, reached a high of 26,273.95 and closed at 26,178.70. Nifty formed a small red candle with upper and lower shadows on the daily chart, resembling a Doji-like candlestick pattern. Its immediate resistance level is now placed at 26,250 while immediate support is at 26,100.

BANK NIFTY: The index opened 86.40 points lower at 59,957.80, reached a high of 60,305 and closed at 60,118.40. Bank Nifty formed a bullish candle with upper and lower shadows. Its immediate resistance level is now placed at 60,300 while immediate support is around 59,800.

Stocks in News

- IEX: Stock surged over 10% after the Central Electricity Regulatory Commission (CERC) informed the Electricity Appellate Tribunal that they are open to withdrawing the July 23, 2025 market coupling order, which previously caused a 30% drop in IEX shares.

- KSH International: Stock rose over 3% after Q2 net profit jumped 129% to ₹29.6 crore, with a 51% YoY revenue increase to ₹712.1 crore.

- Bajaj Auto: Stock hit a 52-week high as December sales rose 14% YoY to 3.6 lakh units, aligning with expectations.

Other News

- Asian and European stocks extended their rally on Tuesday, following Wall Street's lead, where gains in oil companies and financials pushed the Dow Jones Industrial Average to an all-time high.

- Oil prices saw a modest rise on Tuesday as the market balanced expectations of ample global supply this year with uncertainty surrounding Venezuelan crude output following the U.S. capture of President Nicolás Maduro.

- Gold prices also edged higher, reaching a one-week peak, driven by safe-haven demand amidst escalating geopolitical tensions triggered by the U.S. capture of Maduro.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.