Liquide Market Summary 6th February 2026

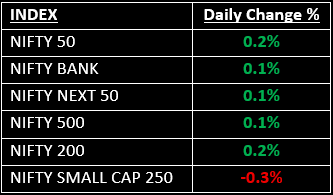

Indian equity indices recovered part of the previous session’s losses in a volatile trading session on February 6, after the RBI’s policy decision matched market expectations. Broader markets were mixed, with the Nifty Midcap index ending flat and Smallcap slipping 0.3%.

Indian Stock Market Today: Indian equity indices recovered part of the previous session’s losses in a volatile trading session on February 6, after the RBI’s policy decision matched market expectations. The Monetary Policy Committee unanimously kept the repo rate unchanged at 5.25% and maintained a neutral stance.

Markets opened lower on weak global cues, with the Nifty initially trading around 25,600. Persistent selling pressure pushed the index below 25,500 during the day, but a mid-session rebound and strong buying in the final hour lifted it close to the day’s high.

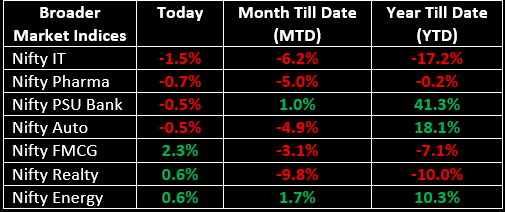

Broader markets were mixed, with the Nifty Midcap index ending flat and Smallcap slipping 0.3%. Among sectors, IT declined 1.5% and Pharma fell 0.7%, while FMCG rose 2.3%. Oil & Gas, Consumer Durables, Private Banks and Realty gained around 0.5-1%.

NIFTY: The index opened 37 points lower at 25,605.80, reached a high of 25,703.95 and closed at 25,693.70. On the daily chart, Nifty formed a bullish candle with a lower shadow, indicating a positive trend with buying interest at lower levels. Immediate resistance is placed at 25,760, while immediate support stands at 25,560.

BANK NIFTY: The index opened 97 points lower at 59,967.10, reached a high of 60,149.90 and closed at 60,120.55. Bank Nifty also formed a bullish candle with a lower shadow, signalling buying interest at lower levels. Immediate resistance is placed at 60,400, with support around 59,800.

Stocks in News

- MRF: Stock surged 8.5% after Q3 net profit more than doubled to ₹691.8 crore from ₹316 crore last year, while revenue rose 15% YoY to ₹8,050.4 crore.

- Data Patterns: Stock gained nearly 8% as Q3 net profit increased 31% to ₹58.30 crore and operating revenue jumped 48% YoY to ₹173.13 crore.

- Life Insurance Corporation: Stock advanced over 7% after Q3 net profit grew 17% to ₹12,930 crore, with net premium income also rising 17% YoY to ₹1,25,988.15 crore.

Other News

- Asian markets mostly declined on Friday as investors pulled back from technology stocks amid growing concerns over the financial impact of artificial intelligence investments.

- European equities edged higher, with gains in defence major Kongsberg outweighing weak preliminary results from Stellantis and caution around software sector outlook.

- Oil prices remained steady as investors awaited developments from high-stakes U.S.-Iran talks in Oman, amid fears of a potential Middle East conflict that could disrupt supply.

- Gold prices rebounded after the previous session’s sharp selloff, supported by weaker global equities and lingering geopolitical tensions. Meanwhile, CME Group raised margin requirements on precious metals to manage rising market risk.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.