Liquide Market Summary 5th January 2026

The Sensex and Nifty ended lower on Monday, pressured by declines in IT stocks and concerns over geopolitical tensions following a US military strike in Venezuela, which resulted in the capture of President Nicolas Maduro and his wife.

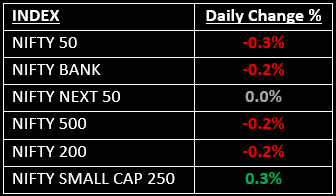

Indian Stock Market Today: The benchmark equity indices, Sensex and Nifty, ended lower on Monday, pressured by declines in IT stocks and concerns over geopolitical tensions following a US military strike in Venezuela, which resulted in the capture of President Nicolas Maduro and his wife. Despite the selling pressure, Nifty managed a modest recovery from the day's low, closing at 26,250, down by 0.30%.

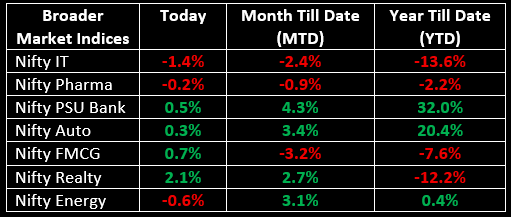

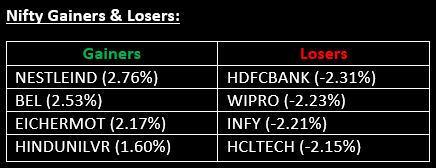

Broader indices fared better, with the BSE Midcap and Smallcap indices closing with minor gains. On the sectoral front, Realty and Consumer Durables led the way, while IT and Oil & Gas emerged as the biggest underperformers.

NIFTY: The index opened flat at 26,333.70, reached a high of 26,373.20 and closed at 26,250.30. Nifty formed a bearish candle on the daily chart, with minor upper and lower shadows. Its immediate resistance level is now placed at 26,300 while immediate support is at 26,200.

BANK NIFTY: The index opened 209.45 points higher at 60,360.40 and closed at 60,044.20. Bank Nifty also formed a bearish candle with minor upper and lower shadows. Its immediate resistance level is now placed at 60,200 while immediate support is around 59,900.

Stocks in News

- PC Jeweller: Stock soared over 7% after the company's standalone revenue rose by 37% in Q3FY26, driven by strong consumer demand during the ongoing festival and wedding season.

- Metropolis Healthcare: Stock gained 6% following a 26% increase in Q3 revenue compared to the previous year. EBITDA margins expanded, despite the quarter being seasonally weaker for the diagnostic industry.

- Dhanlaxmi Bank: Stock jumped 6% as the company’s total business grew by 21% YoY to ₹31,933 crore in Q3, with total deposits increasing by 18% YoY to ₹17,839 crore.

Other News

- Asian markets began the first full trading week of 2026 on a positive note, overcoming geopolitical tensions surrounding Venezuela and broader risk-off sentiment.

- European stocks also saw a strong start to the week, as U.S. military strikes in Venezuela fueled fresh geopolitical concerns, driving investors toward defence stocks on Monday.

- Oil prices edged lower as global supply levels outweighed worries about disruptions to oil flows following the U.S. capture of Venezuelan President Nicolas Maduro, whose country holds the world's largest oil reserves.

- Gold prices surged over 2%, reaching a one-week high, as the U.S. action in Venezuela prompted a flight to safety, boosting demand for the precious metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.