Liquide Market Summary 4th February 2026

Indian benchmark indices ended marginally higher in a volatile session on February 4, despite a sharp sell-off in IT stocks. Broader markets outperformed, with the Nifty Midcap index rising 0.6% and the Smallcap index gaining 1.3%.

Indian Stock Market Today: Indian benchmark indices ended marginally higher in a volatile session on February 4, despite a sharp sell-off in IT stocks. The markets opened in the red amid weak global cues and concerns over the impact of AI, which dragged heavyweight IT stocks lower. However, the Nifty staged a smart recovery from its early low of 25,563.95 and traded within a narrow range for the rest of the session, closing with minor gains.

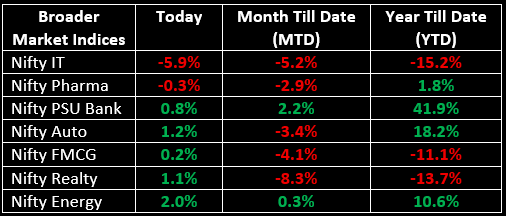

Broader markets outperformed, with the Nifty Midcap index rising 0.6% and the Smallcap index gaining 1.3%. The Nifty IT index plunged ~6%, marking its biggest single-day fall since April 4, 2025, as stocks such as Infosys, TCS, Tech Mahindra, HCL Technologies and Wipro came under heavy pressure. On the other hand, sectors like Auto, Energy, Consumer Durables, Realty, Metal, Oil & Gas advanced 1–2.6%.

NIFTY: The index opened 52.50 points lower at 25,675.05, reached a high of 25,818.55 and closed at 25,776. Nifty formed a bullish candle with a long lower shadow, indicating buying interest at lower levels. Its immediate resistance level is now placed at 25,850 while immediate support is at 25,600.

BANK NIFTY: The index opened 122.05 points higher at 60,163.35, reached a high of 60,389.40 and closed at 60,238.15. Bank Nifty formed a bullish candle with upper and lower shadows. Its immediate resistance level is now placed at 60,450 while immediate support is around 59,800.

Stocks in News

- Sheela Foam: Stock surged nearly 15% after the company’s Q3 profit soared 213% to ₹52.57 crore, while revenue rose 11% YoY to ₹1,074.4 crore.

- Ramco Systems: Stock jumped almost 13% following news that promoters acquired a 2.7% stake in the company through open market transactions at an average price of ₹500/share.

- Lloyds Metals & Energy: Stock rose 10% after the company’s Q3 profit surged 180% to ₹1,089.56 crore, with margins expanding to 34.8% from 32% in the same quarter last year.

Other News

- Asian equities showed mixed performance on Wednesday, as the ongoing losses in U.S. tech stocks continued to dampen market sentiment.

- European markets edged higher, bolstered by solid performances in energy, consumer staples and select financial stocks.

- Oil prices held steady after a U.S. military strike downed an Iranian drone, and armed Iranian boats approached a U.S.-flagged vessel in the Strait of Hormuz, reigniting concerns over escalating tensions between Washington and Tehran.

- Gold prices rebounded to near $5,100, supported by renewed safe-haven demand as U.S.-Iran geopolitical tensions further fueled bullion’s appeal, following its strongest rally in more than 17 years.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.