Liquide Market Summary 3rd February 2026

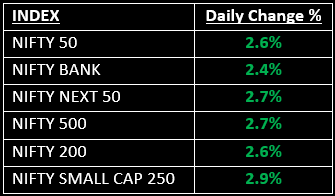

Indian equity markets surged on Tuesday after India and the United States finalized a trade agreement that will see Washington reduce reciprocal tariffs on Indian goods to 18%. The broader market mirrored this strength, with both the Nifty Midcap and Smallcap indices climbing 2.8%.

Indian Stock Market Today: Indian equity markets surged on Tuesday after India and the United States finalized a trade agreement that will see Washington reduce reciprocal tariffs on Indian goods to 18%. Benchmark indices recorded their strongest single-day gain in nine months, driven by Reliance and heavyweight financial stocks.

Export-oriented companies led a broad-based rally as the deal eased a major market overhang and improved investor sentiment. Also Read: India-US Trade Deal: Top Export Stocks to Watch

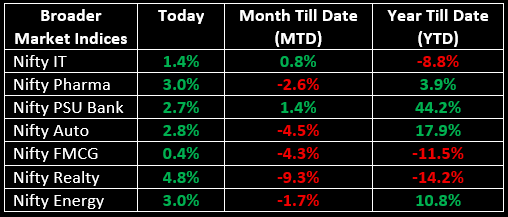

The broader market mirrored this strength, with both the Nifty Midcap and Smallcap indices climbing 2.8%. Sectorally, the rally was widespread, with Pharma, Financials, Realty, Energy and Consumer Durables emerging as top performers, each advancing 3–4%.

NIFTY: The index opened 1,219.65 points higher at 26,308.05, reached a high of 26,341.20 and closed at 25,727.55. Nifty formed a long bearish candle on the daily chart due to profit-booking. Its immediate resistance level is now placed at 25,760 while immediate support is at 25,600.

BANK NIFTY: The index opened 2,792.20 points higher at 61,411.20, reached a high of 61,764.85 and closed at 60,041.30. Bank Nifty also formed a long bearish candle with minor upper and lower shadows. Its immediate resistance level is now placed at 60,300 while immediate support is around 59,800.

Stocks in News

- Aarti Industries: Stock rallied 15% after the company reported a sharp 189% YoY rise in Q3 profit to ₹133 crore, while revenue grew 26% YoY to ₹2,319 crore, reflecting strong operational performance. crore.

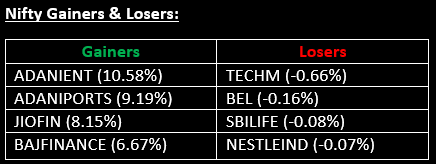

- Adani Enterprises: Stock advanced more than 10%, making it the top gainer in the Nifty 50. Adani Group companies were seen as key beneficiaries of the India–US trade developments, which lifted overall investor sentiment.

- Bharat Forge: Stock climbed over 6% after its subsidiary secured a ₹300 crore equity investment from Premji Invest to support expansion plans. Positive sentiment from the India–US trade deal further supported the move.

Other News

- Asian markets moved higher on Tuesday, supported by positive trade developments — notably the India–US agreement — along with strong momentum in technology stocks.

- Europe’s benchmark index touched a record high as the recent global commodity selloff showed signs of stabilizing, with investor attention turning toward corporate earnings from major companies such as Amundi and Publicis.

- Oil prices slipped for a second consecutive session as markets assessed the potential de-escalation of U.S.–Iran tensions, while a stronger dollar added further downward pressure.

- Gold and Silver surged sharply, with gold on track for its biggest single-day gain since November 2008, as investors stepped in to accumulate precious metals following their steepest two-day decline in decades.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.