Liquide Market Summary 28th January 2026

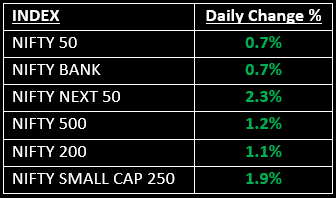

Indian equity markets extended their winning streak for the second consecutive session, driven by buying interest in energy and metal stocks. The broader indices outperformed the benchmarks, with the Nifty Midcap index gaining 1.66% and the Smallcap index rising 2.26%.

Indian Stock Market Today: Indian equity markets extended their winning streak for the second consecutive session on January 28, driven by buying interest in energy and metal stocks.

The market opened positively and continued to climb in the first half. However, mid-session profit-booking pared most of the gains. Yet, final-hour buying propelled the market to close near its day's high.

The broader indices outperformed the benchmarks, with the Nifty Midcap index gaining 1.66% and the Smallcap index rising 2.26%.

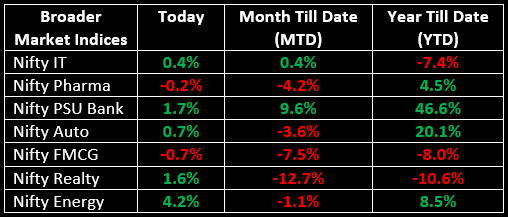

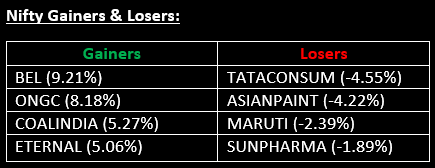

On the sectoral front, Media, Metal, Energy, Oil & Gas, Realty and PSU Bank indices saw gains of 1.5-4%, while FMCG, Pharma and Healthcare sectors ended lower.

NIFTY: The index opened 83.45 points higher at 25,258.85, reached a high of 25,372.10 and closed at 25,342.75. Nifty formed a bullish candle with minor upper and lower shadows, indicating the continuation of the positive trend. Its immediate resistance level is now placed at 25,400 while immediate support is at 25,200.

BANK NIFTY: The index opened 370.20 points higher at 59,575.65, reached a high of 59,699.90 and closed at 59,598.80. Bank Nifty formed a small-bodied bullish candle with a minor upper and a long lower shadow, indicating strong buying interest at lower levels. Its immediate resistance level is now placed at 59,730 while immediate support is around 59,300.

Stocks in News

- Mahindra Logistics: Stock surged nearly 15% after the company reported a net profit of ₹3.25 crore, compared to a ₹9.03 crore loss in the same quarter last year. Revenue climbed 19% to ₹1,898 crore.

- Rail Vikas Nigam: Stock rose nearly 6% following the company’s announcement of securing a ₹242.5 crore order from South Central Railway.

- Suzlon Energy: Stock gained more than 4% after the company secured its first 248.5 MW wind order from ArcelorMittal.

Other News

- Asian markets largely trended higher on Wednesday, with key indices like Korea’s KOSPI and Hong Kong’s Hang Seng posting gains, while other markets showed mixed performance.

- European markets edged lower, weighed down by weakness in luxury and some cyclical sectors, though this was partly offset by strength in tech stocks.

- Oil prices surged to their highest levels since late September on Wednesday, driven by a winter storm that disrupted U.S. crude output, coupled with a weak U.S. dollar and continued outages in Kazakhstan.

- Gold prices rose above $5,300 per ounce for the first time on Wednesday, as diminishing confidence in the U.S. dollar and concerns over the independence of the U.S. Federal Reserve boosted demand for the safe-haven metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.