Liquide Market Summary 27th January 2026

Indian equity benchmark indices ended higher on January 27, recovering part of the losses from the previous session in a highly volatile trading session, as market sentiment received a modest boost following the India–European Union trade agreement.

Indian Stock Market Today: Indian equity benchmark indices ended higher on January 27, recovering part of the losses from the previous session in a highly volatile trading session, as market sentiment received a modest boost following the India–European Union trade agreement.

The market opened on a subdued note and remained rangebound for most of the day, with late buying support helping the Nifty close near the day’s high.

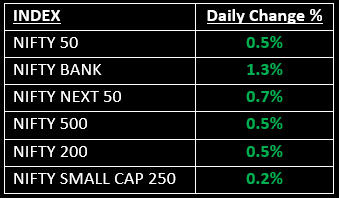

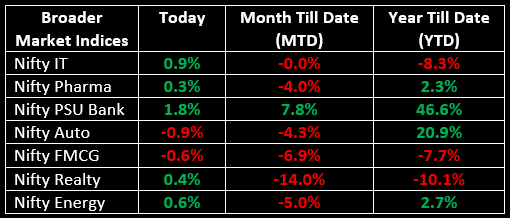

Broader indices performed in line with the benchmarks, with Nifty Midcap and Smallcap indices rising around 0.5% each. Except for Auto, FMCG, Media and Consumer Durables, all other sectoral indices ended in the green, led by the Metal sector which gained 3%.

NIFTY: The index opened 14.70 points higher at 25,063.35, reached a high of 25,246.65 and closed at 25,175.40. Nifty formed a bullish candle with upper and lower shadows, indicating some positive trend along with volatility. Its immediate resistance level is now placed at 25,300 while immediate support is at 25,100.

BANK NIFTY: The index opened 107.05 points lower at 58,366.05, reached a high of 59,436.80 and closed at 59,205.45. Bank Nifty formed a long bullish candle on the daily chart, indicating strong buying interest. Its immediate resistance level is now placed at 59,600 while immediate support is around 59,000.

Stocks in News

- Apex Frozen Foods: Stock surged nearly 12%, along with other Indian seafood exporters, on optimism around the India–European Union trade deal, which is expected to lower tariffs on marine products over a phased period.

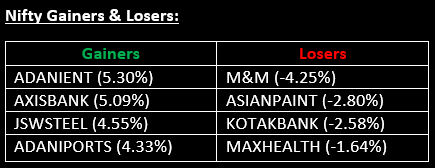

- Axis Bank: Stock rose nearly 5% after the bank’s Q3 profit increased 3% to ₹6,489.6 crore, beating street estimates. Net interest income also grew 5% year-on-year to ₹14,286.4 crore.

- Asian Paints: Stock fell 3% after Q3 profit fell 5% to ₹1,074 crore, despite a 4% rise in revenue to ₹8,867 crore.

Other News

- Asian shares neared record highs on Tuesday as investors remained optimistic ahead of a heavy slate of US large-cap earnings this week.

- European markets also traded higher after India and the European Union concluded negotiations on a long-awaited trade agreement, paving the way for free trade in goods between the bloc’s 27 nations and India.

- Oil prices edged up as a massive winter storm disrupted crude production and refinery operations along the U.S. Gulf Coast. However, gains were capped by the resumption of supply from Kazakhstan.

- Gold advanced on Tuesday, hovering just below the $5,100 per-ounce mark reached for the first time in the previous session, as uncertainty around U.S. President Donald Trump’s policy direction drove investors toward safe-haven assets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.