Liquide Market Summary 26th December 2025

On December 26, Indian benchmark indices closed lower for the third consecutive day, as profit-booking dominated in the holiday-shortened week, compounded by continued selling from FIIs, which weighed on market sentiment.

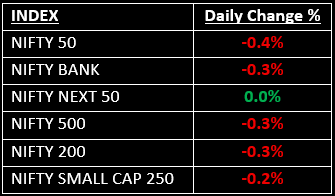

Indian Stock Market Today: On December 26, Indian benchmark indices closed lower for the third consecutive day, as profit-booking dominated in the holiday-shortened week, compounded by continued selling from foreign institutional investors (FIIs), which weighed on market sentiment. Despite the subdued session, the Nifty is up by ~0.3% this week, ending a three-week losing streak.

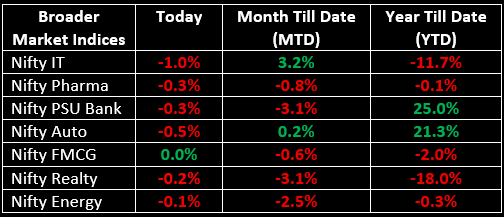

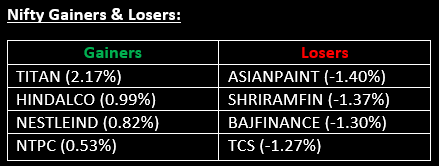

Among broader market segments, the BSE Midcap index fell by 0.2% and the BSE Smallcap index declined by 0.3%. On the sectoral front, the Metals and Consumer Durables indices rose by 0.6% and 0.4%, respectively, while the IT, Auto, Financial Services and Media sectors saw declines ranging from 0.5% to 1%.

NIFTY: The index opened 20.85 points lower at 26,121.25, reached a high of 26,144.20 and closed at 26,042.30. Nifty formed a bearish candle with minor upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 26,100 while immediate support is at 26,000.

BANK NIFTY: The index opened 90.75 points lower at 59,092.85 and closed at 59,011.35. Bank Nifty also formed a small bearish candle. Its immediate resistance level is now placed at 59,250 while immediate support is around 58,800.

Stocks in News

- KNR Constructions: Stock surged nearly 5% after the company signed a pact with Indus Infra Trust to sell its entire stake, including sub-debt, in four highway SPVs. KNR will invest ₹566.83 crore in these SPVs, expecting a total consideration of ₹1,543.19 crore in return.

- Vikran Engineering: Stock rose by 4.5% following the company’s announcement of securing a ₹459 crore order from NTPC Renewable Energy for a 400 MW solar project.

- Dilip Buildcon: Stock gained over 2% after the company received a Letter of Award from Adani Road Transport for an EPC project valued at ₹3,400 crore.

Other News

- Asian stocks largely advanced on Friday, continuing the year-end rally despite low trading volumes, with Japan and Taiwan leading the gains. Meanwhile, major European exchanges remained closed for Boxing Day.

- Oil prices held steady on Friday as investors assessed potential supply risks amid developing geopolitical tensions. This came after the U.S. conducted airstrikes against Islamic State militants in Nigeria and escalated economic pressure on Venezuelan oil. The market saw a thinly-attended post-Christmas session.

- Gold prices surged to a record high during early Asian trading on Friday, driven by safe-haven demand and growing expectations of further interest rate cuts by the U.S. Federal Reserve.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.