Liquide Market Summary 22nd January 2026

After three consecutive days of decline, Indian equity indices made a strong recovery on January 22, driven by positive global cues following US President Donald Trump's withdrawal of his tariff threat against European partners.

Indian Stock Market Today: After three consecutive days of decline, Indian equity indices made a strong recovery on January 22, driven by positive global cues following US President Donald Trump's withdrawal of his tariff threat against European partners.

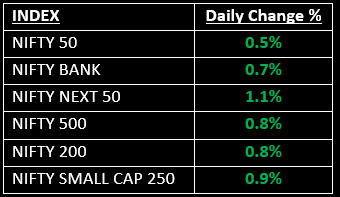

The market opened on a positive note, with the Nifty surpassing 25,300, and continued buying momentum pushed it past 25,400 during intraday trading. However, mid-session profit-booking wiped out the early gains. Renewed buying in the second half of the session helped the indices close in the green.

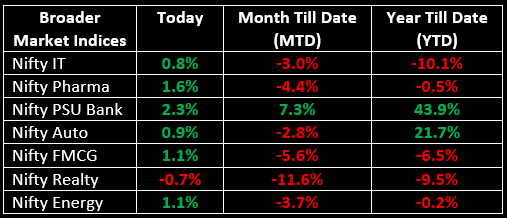

The broader market outperformed the benchmarks, with the BSE Midcap and Smallcap indices gaining over 1% each. Sectorally, while realty and consumer durables lagged, all other indices ended in positive territory.

NIFTY: The index opened 186.65 points higher at 25,344.15, reached a high of 25,435.75 and closed at 25,289.90. Nifty formed a small red candle with upper and lower shadows, resembling a high-wave kind of candlestick pattern. Its immediate resistance level is now placed at 25,400 while immediate support is at 25,200.

BANK NIFTY: The index opened 393.95 points higher at 59,194.25, reached a high of 59,573.10 and closed at 59,200.10. Bank Nifty formed a Doji candle on the daily chart—indicating indecision among bulls and bears. Its immediate resistance level is now placed at 59,550 while immediate support is around 59,000.

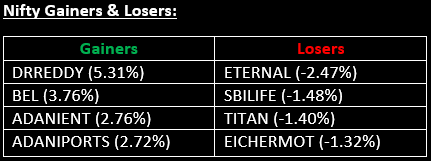

Stocks in News

- Bajaj Consumer Care: Stock surged 20% following a robust Q3 performance, with net profit jumping 83% to ₹46.37 crore, while operating revenue climbed 31% YoY to ₹306.09 crore.

- Waaree Energies: Stock jumped over 9% after the company reported a 118% increase in Q3 profit to ₹1,106.79 crore, with operating revenue soaring 119% YoY to ₹7,565.05 crore.

- Bank of India: Stock gained nearly 6% after the bank's Q3 profit rose 7.5% to ₹2,705 crore, while net interest income increased by 6.5% YoY to ₹6,462.6 crore.

Other News

- European equities rebounded on Thursday, supported by US President Donald Trump’s decision to abandon tariff threats related to Greenland and his ruling out of using force to seize the autonomous Danish territory.

- Asian markets also showed positive momentum, buoyed by easing global geopolitical tensions and a rally in US markets that enhanced risk appetite.

- Oil prices slipped on Thursday, reversing the gains from the previous session, as President Trump softened his stance on both Greenland and Iran. Investors also assessed the supply and demand outlook in the oil market.

- Gold prices pulled back, halting a three-session rally to record highs. Easing tensions over Greenland spurred interest in riskier assets, while the yellow metal was further pressured by fading expectations of U.S. interest rate cuts in the near term.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.