Liquide Market Summary 20th February 2026

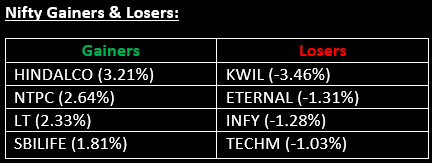

The market staged a strong rebound on February 20, recovering a portion of the previous session’s losses. The Nifty ended the day above 25,550, buoyed by broad-based buying across sectors, with the exception of IT.

Indian Stock Market Today: The market staged a strong rebound on February 20, recovering a portion of the previous session’s losses. The Nifty ended the day above 25,550, buoyed by broad-based buying across sectors, with the exception of IT.

After a subdued start, influenced by rising US–Iran geopolitical tensions, the indices quickly bounced back in early trade. The rally gained momentum as the session progressed, pushing the Nifty to an intraday high of 25,663 before closing with solid gains, despite some profit-booking in the final hour.

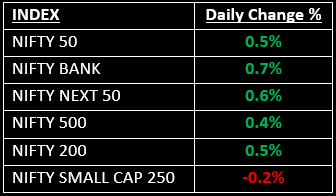

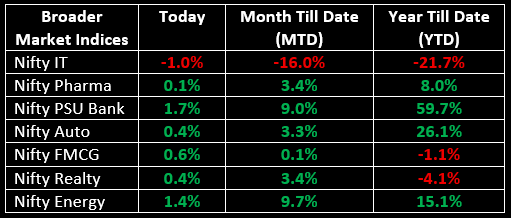

Broader indices were mixed, with the Nifty Midcap index up by 0.5%, while the Smallcap index ended slightly in the red. Sectorally, all sectors, except IT and Media, closed in the green.

NIFTY: The index opened 47.80 points lower at 25,406.55, reached a high of 25,663.55 and closed at 25,571.25. Nifty formed a bullish candle with an upper shadow on the daily timeframe. Immediate resistance is placed at 25,650, while immediate support stands at 25,500.

BANK NIFTY: The index opened 111.70 points lower at 60,627.85, reached a high of 61,360.50 and closed at 61,172. Bank Nifty also formed a bullish candle following a long red candle in the previous session, signalling a rebound. Immediate resistance is placed at 61,350, with support around 60,950.

Stocks in News

- Dee Development Engineers: Stock surged over 10% after the company secured a $40 million order from an international entity for the supply of HRSG piping.

- ABB India: Stock rose nearly 5%, despite an 18% decline in Q4CY25 results. However, revenue climbed 6% YoY to ₹3,557 crore.

- Pace Digitek: Stock gained 3% following the company's receipt of a Letter of Award worth ₹89 crore from RailTel Corporation of India.

Other News

- Asian equities displayed a mixed performance overall, with some markets retreating due to geopolitical and macroeconomic uncertainty, while others, such as Korea, posted gains.

- European shares edged higher on Friday, positioning themselves for weekly gains, driven by a broadly improving corporate earnings outlook and easing concerns over AI disruption.

- Oil prices traded near six-month highs on Friday, on track for their first weekly gain in three weeks, as rising concerns over potential conflict grew. Washington warned Tehran of severe consequences if it doesn't agree to a nuclear deal within days.

- Gold prices rose on Friday, bolstered by ongoing tensions between the US and Iran and lower European bond yields. Investors remained cautious as they awaited US inflation data to gauge the future direction of Federal Reserve monetary policy..

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.