Liquide Market Summary 1st January 2026

The Indian equity indices began 2026 on a positive note, extending gains from the previous session as buying interest emerged across most sectors, except FMCG and Pharma.

Indian Stock Market Today: The Indian equity indices began 2026 on a positive note, extending gains from the previous session as buying interest emerged across most sectors, except FMCG and Pharma. However, mid-day profit-booking erased a large part of the early momentum, leading the benchmarks to close largely flat.

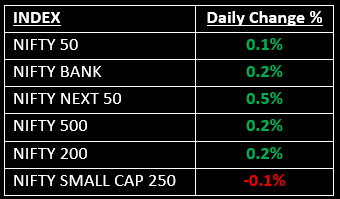

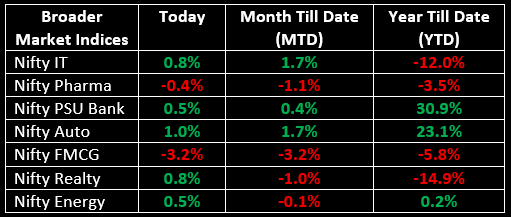

In the broader market, the BSE Midcap index advanced 0.3% while the BSE Smallcap index ended flat. Sectorally, FMCG stocks underperformed, with the index declining 3% while the Pharma index slipped 0.4%. In contrast, Auto, IT, Metal, Realty and PSU Bank indices posted gains in the range of 0.4% to 1%.

NIFTY: The index opened 43.70 points higher at 26,173.30, reached a high of 26,197.55 and closed at 26,146.55. Nifty formed a small bearish candle with upper and lower shadows, indicating range-bound trade. Its immediate resistance level is now placed at 26,200 while immediate support is at 26,080.

BANK NIFTY: The index opened 92.95 points higher at 59,674.80 and closed at 59,711.55. Bank Nifty formed a small-bodied bullish candle on the daily chart. Its immediate resistance level is now placed at 59,800 while immediate support is around 59,400.

Stocks in News

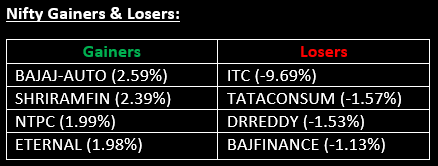

- APL Apollo Tubes: Stock rose about 3% after reporting record sales volumes of 9,16,976 tonnes in Q3 FY26, up 11% year-on-year and 7% sequentially from 8,55,037 tonnes in Q2 FY26.

- ITC: Stock plunged nearly 10% after the finance ministry notified an additional excise duty of ₹2,050 to ₹8,500 per 1,000 cigarette sticks, over and above the existing 40% GST, effective February 1.

Other News

- European and Asian stock markets remained closed on Thursday for the New Year holiday.

- The rupee settled at 89.96 per dollar, down from 89.87 on Wednesday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.