Liquide Market Summary 19th January 2026

Indian equities started the week on a cautious note, with the Nifty briefly dipping below the 25,500 mark intraday, as weak global cues sparked broad-based profit-booking. Renewed concerns over a potential global trade war, coupled with mixed earnings results, weighed on market sentiment.

Indian Stock Market Today: Indian equities started the week on a cautious note, with the Nifty briefly dipping below the 25,500 mark intraday, as weak global cues sparked broad-based profit-booking. Renewed concerns over a potential global trade war, coupled with mixed earnings results, weighed on market sentiment. However, selective buying in FMCG and Auto stocks helped the benchmarks recover from their intraday lows.

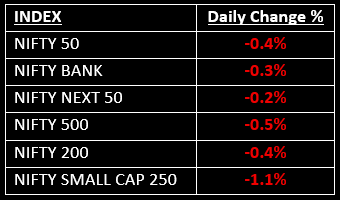

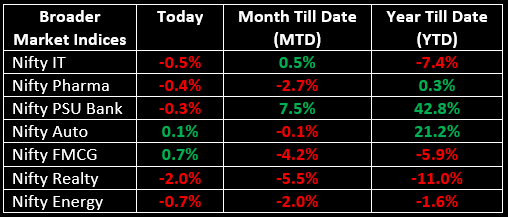

Among the broader indices, the BSE Midcap index mirrored the benchmark’s decline, falling 0.4%, while the Smallcap index underperformed, falling 1.3%. On the sectoral front, apart from FMCG and Auto, all other sectors closed in the red.

NIFTY: The index opened 41.25 points lower at 25,653.10, reached a high of 25,653.30 and closed at 25,585.50. Nifty formed a bearish candle with a long lower shadow, indicating weakness at higher levels but buying interest at lower levels. Its immediate resistance level is now placed at 25,640 while immediate support is at 25,480.

BANK NIFTY: The index opened flat at 60,093.30, reached a high of 60,107.50 and closed at 59,891.35. Bank Nifty also formed a bearish candle with a long lower shadow. Its immediate resistance level is now placed at 60,100 while immediate support is around 59,600.

Stocks in News

- CG Power: Stock surged 5% after the company secured a ₹900 crore order from Tallgrass Integrated Logistics Solutions LLC for a large-scale data center project in the U.S.

- Hatsun Agro Product: Stock rose nearly 3% following a 48% jump in net profit to ₹60.6 crore, while revenue increased 18% YoY to ₹2,364 crore.

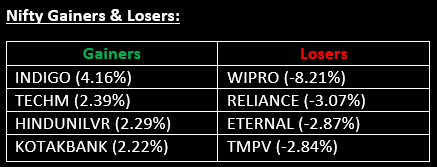

- Wipro: Stock plunged 8% after the IT major reported a 7% decline in Q3 profit, which slipped to ₹3,119 crore, despite steady revenue growth.

Other News

- European and major Asian equities traded lower as global risk sentiment soured, driven by geopolitical uncertainties—particularly tariff threats in global trade—and cautious positioning ahead of key economic data.

- Oil prices fell by 1% on Monday, reversing the previous session's gains, as civil unrest in Iran subsided, reducing the likelihood of a U.S. attack that could disrupt supply from the key Middle Eastern producer.

- Gold and Silver hit record highs on Monday, fueled by a flight to safety after U.S. President Donald Trump warned of additional tariffs on certain European countries in a dispute over Greenland.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.