Liquide Market Summary 16th February 2026

Indian benchmark indices snapped their two-day losing streak on February 16, ending higher after a volatile trading session, with the Nifty closing above the 25,650 mark.

Indian Stock Market Today: Indian benchmark indices snapped their two-day losing streak on February 16, ending higher after a volatile trading session, with the Nifty closing above the 25,650 mark. The market opened on a weak note amid mixed global cues, pulling the Nifty below 25,400 in early trade.

However, strong buying interest triggered a swift rebound, and momentum strengthened as the session progressed, pushing the index close to 25,700 before it settled near the day’s high at the close.

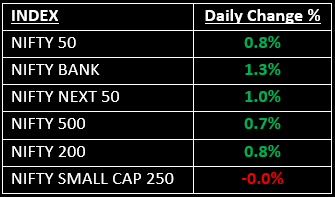

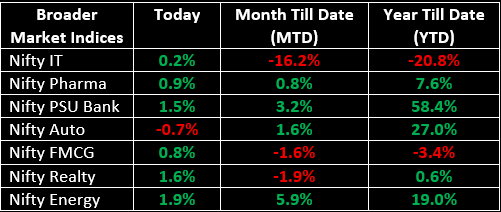

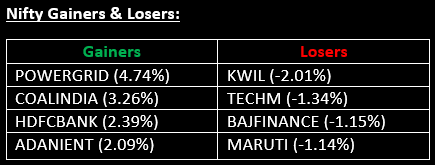

Broader markets underperformed the benchmarks, with the Nifty Midcap index rising 0.5% while the Smallcap index ended largely flat. Sectorally, PSU Banks, Realty, Private Banks and Energy advanced 1–2%, whereas Media and Auto declined by 0.7–1%.

NIFTY: The index opened 47.50 points lower at 25,423.60, reached a high of 25,697 and closed at 25,682.75. Nifty formed a bullish engulfing candle on the daily chart, signalling a potential bullish reversal. Immediate resistance is placed at 25,750, while immediate support stands at 25,600.

BANK NIFTY: The index opened 238.85 points lower at 59,947.80, reached a high of 61,011.30 and closed at 60,949.10. Bank Nifty also formed a bullish engulfing candle on the daily chart. Immediate resistance is placed at 61,400, with support around 60,700.

Stocks in News

- Precision Wires: Stock surged more than 14% after reporting a strong Q3 performance, with profit jumping 99% to ₹37.7 crore and revenue rising 37% YoY to ₹1,347.6 crore.

- Natco Pharma: Stock gained around 7% after securing CDSCO approval to launch Semaglutide in India, a key medication used for chronic weight management and the treatment of type-2 diabetes.

- BSE: Stock plunged over 7% following the RBI’s move to tighten lending norms for capital market intermediaries, a development that could increase funding costs and potentially pressure margins across the sector.

- Read more: RBI’s New Credit Norms for Brokers (2026): A Strategic Guide for Investors

Other News

- Asian markets delivered a mixed performance on Monday as trading volumes remained thin, with major markets such as China, South Korea and Taiwan closed for holidays.

- European equities inched higher, with the STOXX 600 supported by gains in financial stocks ahead of industrial production data, while investors also positioned themselves for a fresh batch of corporate earnings later in the week.

- Oil prices remained largely steady as markets assessed the potential impact of upcoming U.S.–Iran talks aimed at easing geopolitical tensions, even as expectations of higher supply from OPEC+ capped sharp upside.

- Gold prices declined, pressured by low liquidity due to holiday closures in key U.S. and Asian markets, while a stronger dollar further weighed on the precious metal.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.